If you want to know the key facts about the biggest U.S. real estate property portals—from revenue figures to recent controversies—you're in the right place.

Online Marketplaces regularly reports on and analyses real estate portals in the United States and has compared and contrasted the three biggest players —Zillow, Realtor.com, and Homes.com—so you don't have to.

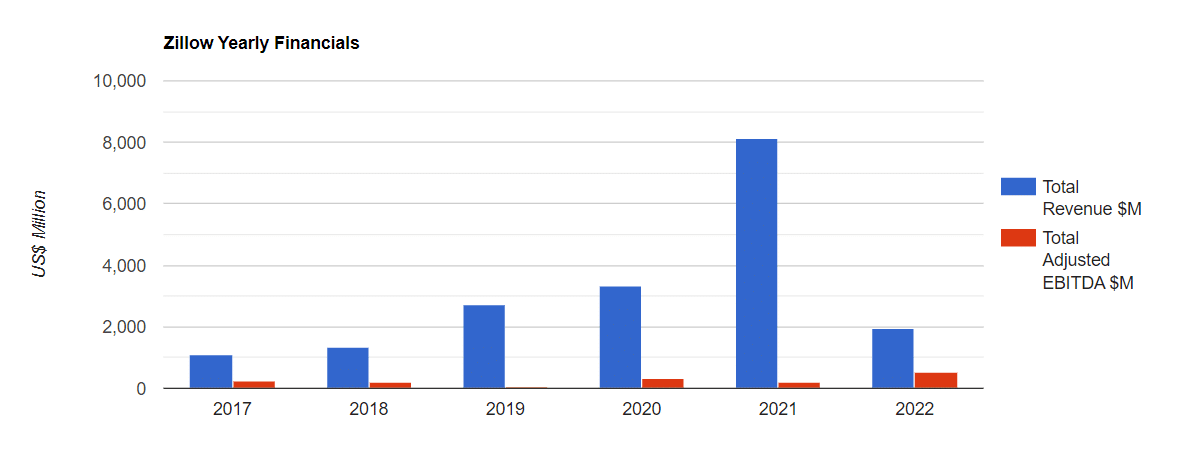

Zillow is, simply put, one of the most powerful portals not only in North America but in the world. The company, founded in 2006, makes billions of dollars every year, even after the collapse of its iBuying home renovations business in November 2021.

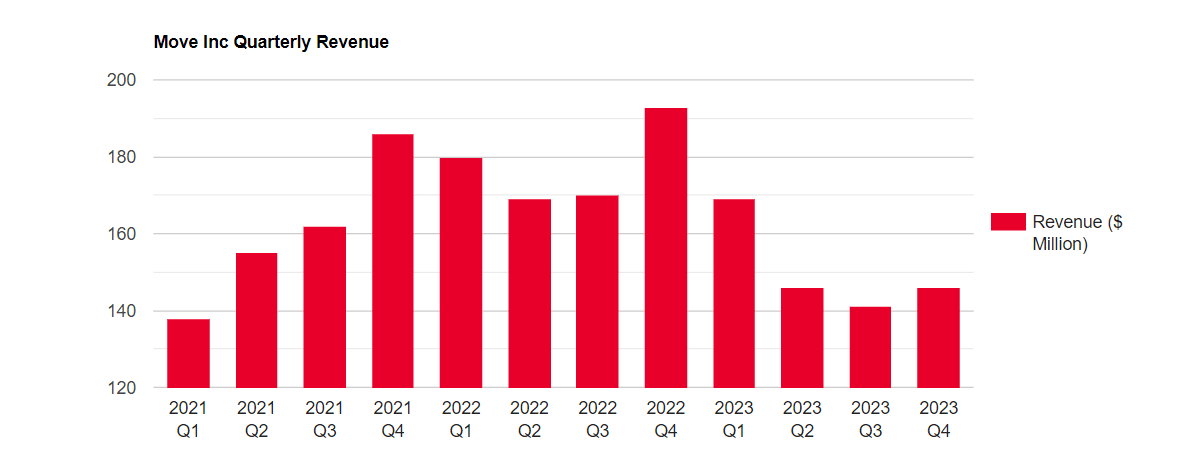

Realtor.com historically plays runner-up to Zillow. Founded in 1995, Realtor.com was initially backed by the National Association of Realtors but these days the relationship between the portal and the industry association isn't as strong as it once was.

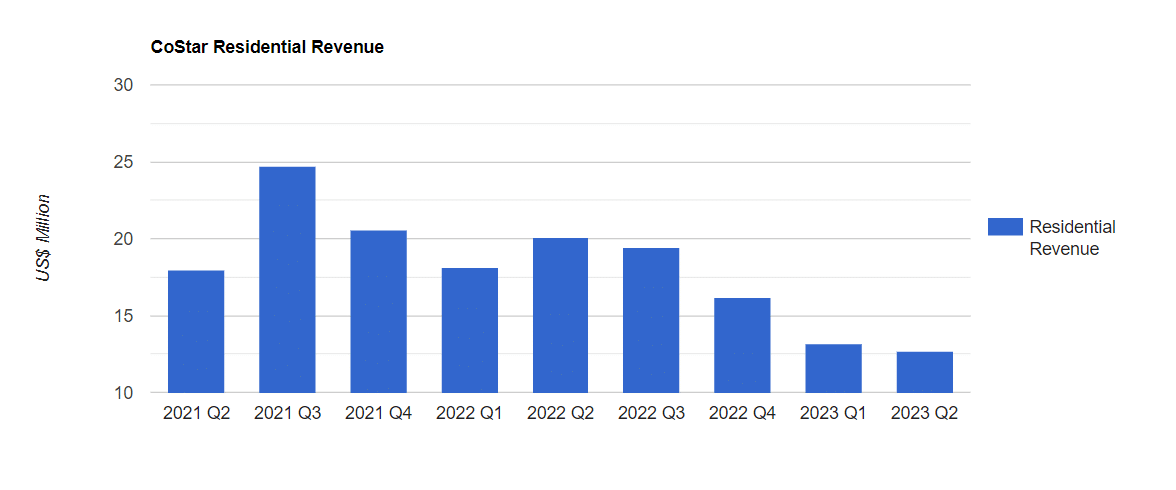

Homes.com is the new kid on the block. It was bought by the commercial real estate giant CoStar Group in 2021 and has been on a clear upward trajectory ever since.

Though Homes.com isn't yet a challenger to Zillow's portal platform, CoStar is a powerful entity that has vowed to topple Zillow. For now though, Homes.com, as part of CoStar's 'Residential' business segment, is 'only' making between $10-$20 million in revenue per quarter.

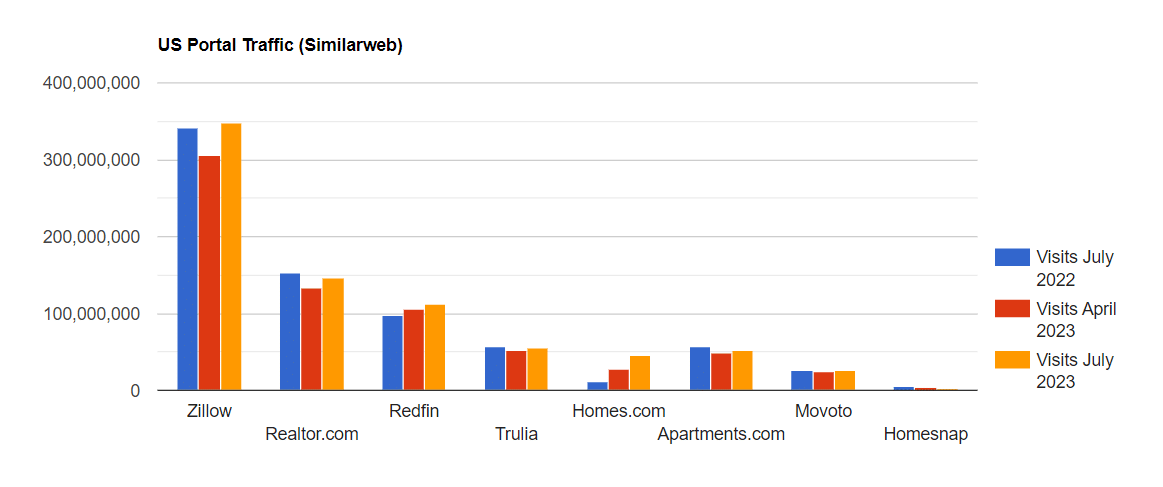

Zillow has the most traffic of any U.S. real estate portal according to Similarweb. Realtor.com comes in second but recently admitted that it lost 20% of its traffic between March and July 2023 compared to the same period last year.

It's worth noting that Zillow's traffic was also down 8% for the period as the market suffered from high mortgage rates and low inventory.

CoStar has been pulling out all the tricks to boost traffic to number three player Homes.com and recently started diverting traffic from Homesnap.com (which it also owns) to Homes.com. At some point soon the company is expected to launch a big national media campaign to drive awareness and traffic to Homes.com.

Zillow is owned and operated by Zillow Group, a publicly traded company.

Realtor.com is owned by parent company Move, Inc. In 2014, Move was sold to the media corporation Newscorp with the Australian company currently owning 80% of the shares in Move, while the Australian specialist portal company REA Group owns 20%.

Homes.com is owned by CoStar Group, which also owns Apartments.com and Homesnap.com.

The relationship between Move, Inc. (Realtor.com) and CoStar Group (Homes.com) is interesting. CoStar was rumoured to be looking into acquiring Realtor.com from Move, Inc in 2022 but withdrew from the potential $3 billion deal this year in favour of using its cash reserves to improve Homes.com instead.

In its most recent financial results, CoStar boasted that it has overtaken Redfin and Realtor.com in consecutive quarters to become the operator of the U.S.'s number two portal network (in terms of traffic) for the first time.

Meanwhile, Move, Inc is also experiencing a management change with CEO David Doctrow being replaced by long-time News Corp executive Damian Eales—who said his goal was to retake the top spot from Zillow... while also fighting off CoStar.

Zillow makes most of its money from its Premier Agent product which sells buyer leads to agents. When a user fills in the contact form on the website or app their details are sold to participating agents as leads. The model is somewhat controversial in the industry as the agent receiving the lead may not be the agent listing the property.

Unlike most real estate portals around the world, agents do not pay to list on Zillow or any other real estate portal thanks to the MLS system. Because Zillow is a member of the National Association of Realtors it has access to a so-called IDX feed of all the listings that are available on MLSs around the country.

In recent years Zillow has expanded the ways in which it generates its revenues which now include:

Until November 2021 Zillow was in the 'iBuying' business which involves buying houses and renovating them before selling them. Zillow's big bet was that its famous Zestimate algorithm could accurately estimate the price of houses and that if it bought enough of them it could achieve scale and get customers to use its mortgage service.

Things didn't work out and the company shut down its iBuying program having lost hundreds of millions of dollars.

While Zillow no longer buys houses, in August 2022 it did announce a partnership with iBuyer Opendoor which has been expanding ever since. Zillow users in certain local markets can get an offer on their house through the partnership with the Opendoor iBuyer.

Realtor.com makes its money in a fairly traditional sense, by selling leads to real estate agents and offering advertising space to agents, brokers and other parties involved in the real estate industry.

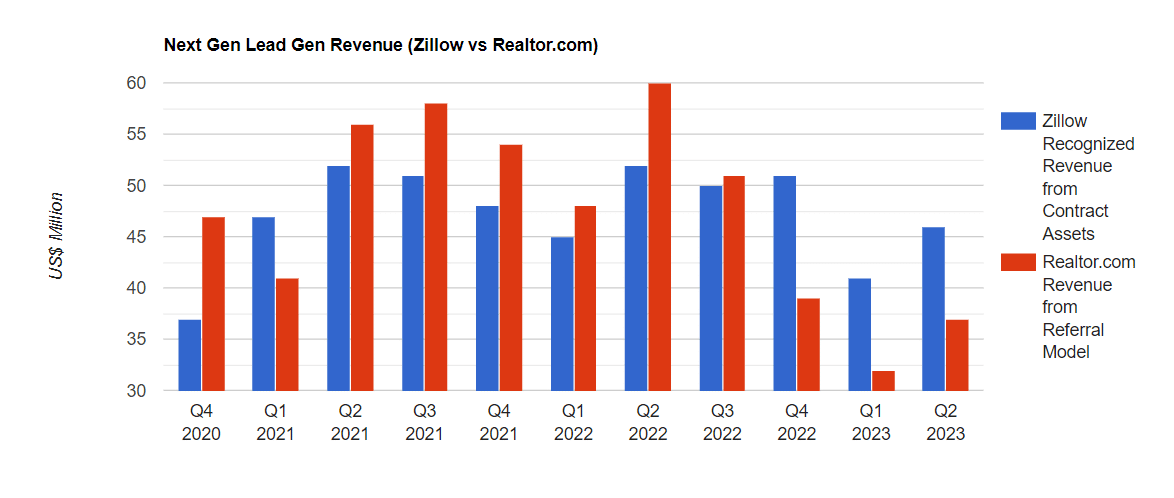

Since buying the lead qualification service OpCity in 2018, Realtor.com has also been a pioneer of the so-called next-gen-lead-gen model whereby agents pay a percentage of their commission for the portal company to generate and then refine or filter leads for them.

Homes.com has made waves in the industry by promising not to sell leads to agents.

Its parent company, CoStar promotes the "your listing, your lead" mantra and will instead make money by charging agents for extra visibility packages; so although agents receive leads from their listings for free, the ones who want to get more leads from the portal will pay Homes.com to put their listings at the top of the portal's search results pages.

This is a common business model for portals outside of the U.S. and one that CoStar has used successfully in commercial and rental real estate.

This is a tricky and controversial issue. The simple answer is no. Zillow and other real estate portals in the U.S. have all home listings that are on the MLS... but not all home listings are on the MLS.

The National Association of Realtors' Clear Cooperation Policy says that agent members should upload all home listings to the MLS within one business day of beginning to market them. But there is a loophole.

Big national brokerages like Compass can get around the policy by marketing listings internally only to other Compass agents, effectively creating what's called a 'pocket listing'. These pocket listings won't appear on Zillow and other third-party real estate websites.

It has been argued that pocket listings are bad for fair housing, while some big brokerages see them as a competitive advantage and an integral part of their business model.

We regularly look at and compare the features that real estate portals from around the world have. In 2021 we looked through 650 of them to find out which features were industry standard and which were still new.

We reviewed the features on the major U.S. real estate portals earlier this month (August 2023) to see which features they do and don't have.

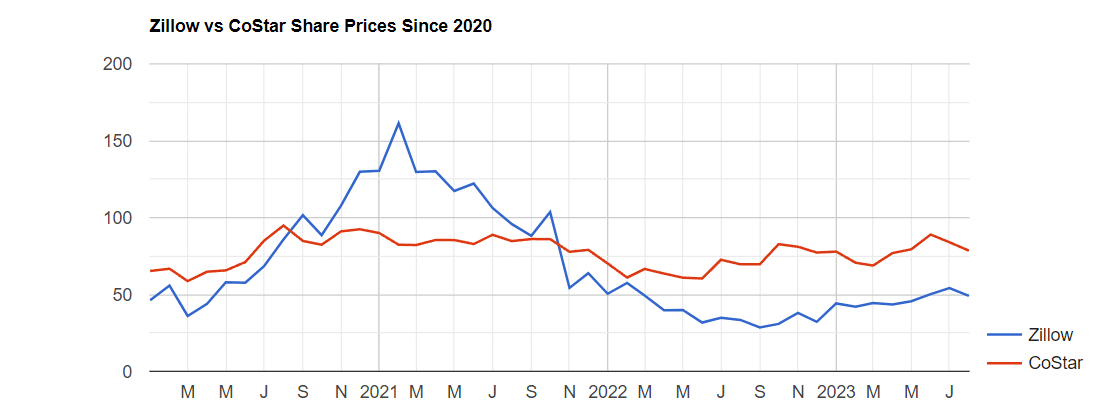

Zillow's share prices crashed after it shut down the iBuying business, but has since recovered slightly. Matching the heights of 2021's $161 per share is a way off though.

CoStar has had more gradual growth in the past three years but has yet to reach the record $94 per share it achieved in August 2020—despite a streak of 49 consecutive quarters with double-digit year-on-year revenue growth and being included in the prestigious S&P 500 index.

Zillow is never far from the headlines, and 2023 is no exception. A lot of column inches have been dedicated to lawsuits involving Zillow, including a case brought by its own shareholders in 2017.

However, the company continues to innovate in spaces including artificial intelligence, while the portal's Q2 FY23 results boasted revenues of over half a billion dollars.

Realtor.com hasn't achieved the same success as Zillow this year, with the company's year-on-year traffic and revenue dropping by over 20% each, and the company transitioning to a new CEO in the form of Damian Eales in June.

The new guy has admitted that he's "pissed off" with being in second place and is aiming to follow the one-word order from his Newscorp bosses.

"Of course we don’t want to be No. 2. We were No. 1. We predate Google in the digital industry. We were created in 1995. We are the original listings site. We were No. 1 for many years. Something happened where Zillow took that crown off us — and I want it back," Eales said to an audience of real estate professionals at the recent Inman Connect conference.

Homes.com received a boost when owner CoStar withdrew from the Realtor.com deal, meaning the portal will likely be pumped full of investment in the coming years. As a follow-up, CoStar Group opted to 'sunset' Homesnap in favour of Homes.com—just three years after acquiring it for $250M.

And CoStar CEO Andy Florance celebrated "another great quarter" in Q2 2023 with the company overtaking Redfin and Realtor.com in consecutive quarters to become the operator of the U.S.'s number two portal (in terms of traffic) for the first time.

Read everything you need to know about the world of property portals, for free on Online Marketplaces!