The American portal operator Zillow has released its results for the fourth quarter and financial year 2021. Highlights of which include:

Zillow delivered record numbers in its revenue columns for both the year and the quarter with the equally enormous caveat that as it winds down its iBuying business following a spectacular admission of defeat in November 2021. it is selling houses without purchasing any new ones.

Overall revenue for the year was $8.1 billion while Net Loss was $528 million. For the quarter, revenue was $3.9 billion (largely thanks to the Homes segment sell-off) while Net Loss was $261 million.

The headline figure is that Zillow's iBuying misadventure cost the company $881 million in 2021 alone. The company is putting that phase behind it as it sells off the remaining housing stock it was buying like crazy to match former iBuying rival Opendoor in the second half of 2021.

No specifics were given about the number of homes sold or the number still on the company's books but Zillow CEO, Rich Barton did say in a letter to shareholders that efforts to wind down the operations of the company's Homes segment were progressing "faster than we anticipated at better unit economics than we projected".

Zillow's core business is its IMT segment which houses all of its revenues from media activities and its flagship Primer Agent advertising product for agents. The segment saw revenues grow overall by 14% for the quarter on a year-on-year basis with Premier Agent growing 13%.

Zillow is widely expected to expand its Flex lead generation product to come close to the relative volume of revenue generated by its competitor Realtor.com through its lead generation program, Opcity. However, no mention was made of Flex in either the shareholder letter or press release for Zillow's results.

Like many portal companies around the world, Zillow has struggled to make its share of consumer interest and brand recognition count in the ultra-competitive mortgage arena despite its best efforts and hundreds of millions spent on the problem.

Although the revenue of Zillow's mortgages segment was at the high end of the company's outlook at $51m, the segment lost $14.6m in Adjusted EBITDA over the quarter and the Net Loss for the year was $51m as a tight housing market and lack of new listings took hold over the second half of the year.

Despite the fact that the mortgage business remains very dependent on the state of the domestic housing market, Zillow still sees a big opportunity for the segment. In a letter to shareholders, the company made reference to the importance of providing "intuitive and reliable pre-approval and pre-qualification" in engaging customers and keeping them within Zillow's funnel.

In his letter to shareholders Barton reiterated the company's commitment to making not only finding a new home, but also moving into it easier via 'Zillow 2.0' and introduced the idea of a 'housing super app', described as:

"... an integrated digital experience in which Zillow connects all the fragmented pieces of the moving process and brings them together on one transaction platform."

Barton went on to speak about the market share that Zillow has gained over the years - 25% of homebuyers in the U.S. last year clicked a button to connect to a Zillow Premier Agent - and about the further opportunities that lie ahead for a company that enjoys unrivalled dominance at the top of the real estate funnel.

According to Barton, Zillow's plan is to grow engagement with Zillow's audience with tools such as interactive floor plans, 3d tours and affordability tools, improve the integration with ShowingTime and also "preparing these customers to be transaction-ready through intuitive and digitized mortgage offerings".

The part of Barton's plan which will have piqued the interest of an industry playing close attention though was the reference to Zillow's development of "more asset light" seller solutions. The company clearly wants to develop its offering on the other side of transactions and "open up access to the 6.1 million sell-side customer transactions that mirror the 6.1

million buy-side transactions that we’ve been focused on to date".

Many commentators had predicted that Zillow would pivot into 'power buying', the increasingly popular way to inject liquidity into housing transactions which involves less risk than iBuying as it does not involve renovating or reselling homes. Barton's words will have many predicting either an acquisition or large scale product development to put Zillow in the 'power buying' game later in the year.

While those in the real estate industry will have been paying keen attention to the details of Zillow's plans, there can be no doubt which sentence of Barton's missive will have caught the eyes of Wall Street investors. The opportunity in front of Zillow and its 'housing super app' is apparently big enough for Barton to reach for the bold button on his keyboard when declaring that the company

"expect[s] all of these efforts to translate into $5 billion in annual revenue and 45% EBITDA margin by the end of 2025."

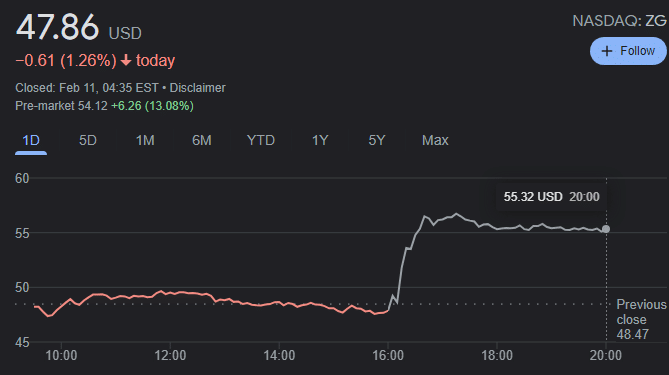

Clearly then, Zillow has come out swinging after being knocked back against the ropes by its iBuying failure. Many investors had been sitting on the fence keenly awaiting yesterday evening's results and enough of them seem to have been sufficiently encouraged to have buoyed the company's share price by 13% in pre-market trading.

Zillow share price 11/02 (pre-market). Credit - Google Finance