For U.S. real estate portals the Multiple Listings Service is both a blessing and a curse.

While it means that any aspiring real estate marketplace can show pretty much any listing for sale in the country just by signing up, it also means that the barrier to entry is low and the lucrative business of charging agents just to list on your website isn't a viable option.

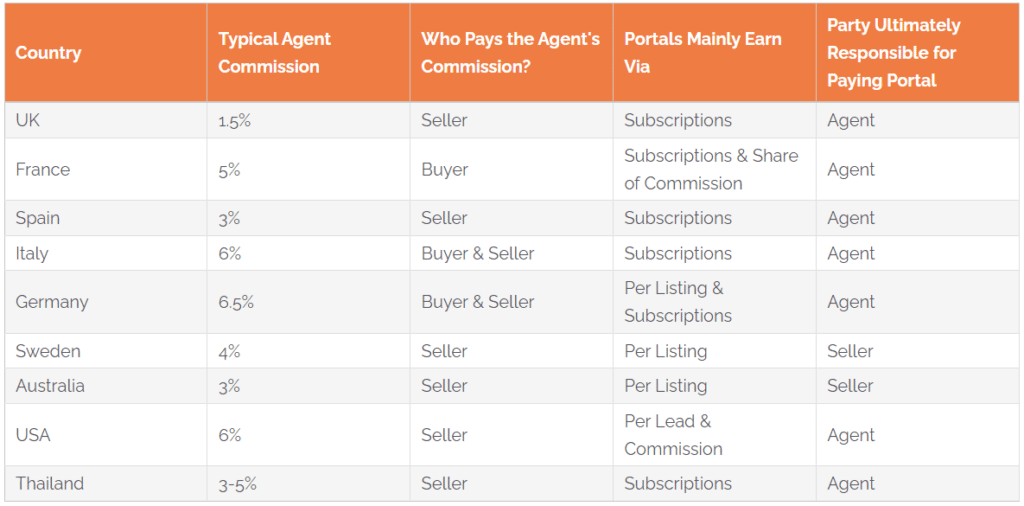

Whereas in most European markets, portals charge agents to list on their website and app, in the United States real estate portals typically make money by charging agents for leads.

This means that the network effects keeping agents hooked on their product aren't as strong for Zillow as they are for, say, Rightmove in the UK.

Although the relative traffic share of the two portals might be similar, an agent that chooses not to pay Zillow will still have their listing shown on the portal but a listing from an agent that doesn't pay Rightmove won't even make it onto the website.

It's very hard to tell but a good guess might be that 90% of British estate agencies pay to list on Rightmove and at least 75% of those wish they didn't have to. Most agents dislike Rightmove for raising prices every year but few have the guts to wean themselves off the exposure Rightmove provides let alone tell potential vendors that their home won't appear on the country's most popular marketplace.

Across the pond, all agents that upload their listings to the MLS are listed on Zillow automatically but maybe less than half actually pay the portal for leads and most of those that pay are happy to do so. If Zillow's customers aren't happy it's easy enough for them to leave.

Where Rightmove can keep agents locked into long contracts and raise prices because the agents feel they need their listings to be on the portal, most agents in the U.S. say that Zillow only locks them in for six months.

Whenever the word 'Zillow' comes up on the popular r/realtors forum on Reddit, opinion seems to be split into three distinct camps:

Like every publicly traded company and especially those that have costly recent mistakes on their ledger, Zillow needs to look to increase the money it makes and show investors the direction it's heading.

Trying to increase revenue by increasing agent customer numbers would take an almighty PR crusade to try and win over groups 2 and 3 and would have no guarantee of success.

What the Seattle-based company is doing instead is squeezing more juice from its friendly customers in group 1. The ones it doesn't need to persuade or win over.

It's doing this with what it calls its 'post pay' model which sees agents pay Zillow a percentage (typically between 25-35%) of the commission they earn on a sale.

In return for this substantial slice of the transaction, Zillow does for agents the part of their jobs they like least - qualifying leads and weeding out tyre kickers.

This post-pay model, known as 'Flex' is offered alongside Zillow's traditional agent lead gen product 'Premier Agent' in almost all regional markets around the country. There are, however, six markets in which Zillow is doing some very important experimenting.

This week the company announced that it would be creating two more of its 'Enhanced Markets'. The metro areas of Durham and Charlotte in North Carolina would join Raleigh, Denver, Atlanta and Phoenix as areas that Zillow only works with the Flex model. This means that the portal company has had to actually end the monetary relationships it had with hundreds of agents in those markets for the sake of its experiment as the Flex program is invite only.

It's not just Zillow's agent customers that have a different experience in the enhanced markets. End users in the six markets get what the company calls "real-time touring" where they can book a tour of a home through the portal in less than an hour. Significantly, the company is also experimenting with ways to finally crack the code and better integrate its mortgage services into its customer flow.

The program was first announced in April 2021 and its level of success over the medium term may well have a big impact on Zillow's business as it builds towards its 'housing super app' strategy and for the U.S. real estate marketing landscape in general.

For now though, notwithstanding some mildly encouraging signs on the mortgage integration front, the returns are nothing to write home about.

Zillow does not directly disclose the revenue generated from Flex but it does say that most of what constitutes 'Revenue from Contract Assets' comes from its Flex program. Realtor.com's 'Referral Model' is Zillow's rival's equivalent of Flex.

Whisper it quietly, but by going deeper towards property transactions and only working with a small, select group of agents Zillow is starting to look less and less like what we think of as a real estate portal and more like something else... a brokerage.

Zillow already got all the state brokerage licences it told agents it didn't really want by 2020 and then followed up by buying out ShowingTime, the popular showing management software company in 2021.

As well as admitting to seeking and getting more control over the agents it chooses to work with in the Flex program, the portal company now provides a lot of the services that agents would have looked to their brokerage or a specialist for a few years ago:

Quite apart from the agent opprobrium that it would generate, being a full-on bricks-and-mortar brokerage has not been a profitable line of business in the United States for most over the last few years so it's doubtful that Zillow will fully take the plunge on being a brokerage.

That isn't to say that it won't continue to look more and more like one as it continues to roll out 'post pay' to more and more 'enhanced markets' over the next few years of 'super app' development.

Zillow knows that it will probably never win over the agents that hate it. Unlike in markets like the UK, where agents hate Rightmove but think they need to pay anyway, haters don't need to pay Zillow.

So it makes sense to make more money off the agents that do like Zillow's services. Going further into the transaction and closer to fulfilling the role of a brokerage while all the while saying all the right things seems like a sound business decision.