The U.S. real estate giant CoStar was already an incredibly successful company before it embarked on its mission to take over the residential market on both sides of the Atlantic.

The Washington-based behemoth has publicly stated that it plans (or even expects) to overthrow the U.S. market's leading real estate portal, Zillow and its British counterpart, Rightmove.

Andy Florance's company may be worth $34 billion and may have a decent track record of creating market leaders, but even so, those are some lofty ambitions.

We've been covering CoStar's simmering threat to the status quo for some time now and 2024 feels like the year it might start to boil over. As we await the next wave of headlines we've been analyzing CoStar's chances of dethroning two of the most entrenched market-leading portals anywhere in the world...

Perhaps it was extraordinary prescience that led Andy Florance to name the real estate company he founded in 1987 'CoStar'. Over thirty years later, ever since he decided to move into the residential market the savvy CEO has been able to talk up the 'co-starring' role his company plans to play alongside real estate agents and contrast this with competitors.

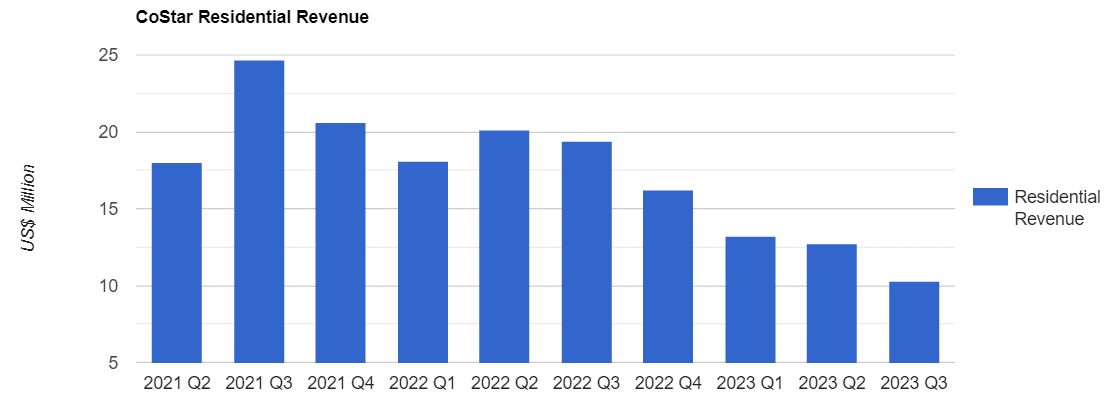

That decision to expand CoStar's empire from data intelligence, commercial and rentals to residential sales was taken before its plans to acquire RentPath and CoreLogic failed (in 2020 and 2021 respectively) but the fate of those bids likely accelerated and focussed efforts to move in on Zillow's territory.

By mid-2021 the company had bought up Homesnap and the challenger portal Homes.com and it was clear that CoStar saw its next big phase of growth coming in residential and coming at the expense of Zillow.

Since then the PR has shifted up a gear with Florance never missing a chance to tell interviewers that Zillow's model of allowing buyers' agents to advertise on the listings of other agents leads to a terrible user experience. Actions at Homes.com matched CoStar's words as the portal turned off its pre-buyout monetization model which was similar to Zillow's.

In October 2023, after deciding not to pay a reported $3 billion for Newscorp's Realtor.com, CoStar sent out a press release claiming that it had overtaken Realtor and was now the proud owner of the second-most trafficked residential real estate marketplace network in the U.S. market.

During the same month, Florance appeared on stage at Property Portal Watch to serve notice to European real estate portals that CoStar intended to cross the Atlantic and had a $9 billion war chest at its disposal to do so. Two weeks after that, a £100 million deal to acquire British number three player OnTheMarket was announced.

Launched by disgruntled agents in 2016, OnTheMarket's mission was to provide competition to Rightmove. After a rocky few years during which its unpopular boss Ian Springett insisted that agents only list on one other portal, OnTheMarket was taken over by former agent Jason Tebb and started to see a moderate upturn in fortune.

OnTheMarket did a good job of mending fences with agents once Springett left but always lacked the funds to truly compete with Rightmove even with the proceeds of a float on the London Stock Exchange in 2018.

That's all changed now with CoStar having pledged to spend £46.5 million on sales and marketing over its first full year of ownership.

So the game is on. What chance do the challengers have?

The first and perhaps most important thing to point out when assessing the chances of a challenger real estate portal in North America is that it won't suffer from the biggest problem that challengers encounter in every other market—listings coverage. Thanks to the uniquely collaborative MLS system, Homes.com already had over 90% of the listings available in the United States even before it was bought up.

So CoStar doesn't have to convince every agent in the land to list on its portal but if it did, it could craft a sales pitch pretty easily.

Although it's yet to be fully revealed, Homes.com's business model looks to be similar to 'freemium' models used in other markets which see listing agents get free leads, only paying if they wish to upgrade their visibility or buy extra premium services. They also won't have to put up with their listings being used to advertise other agent's services—a common complaint against Zillow's way of working.

Above: Homes.com has started its marketing and PR campaign targeting agents on Linkedin.

There's also a pretty compelling USP for the end user. Homes.com prides itself on putting the user in touch with the agent who's actually listing the property they're interested in rather than some other agent that paid to advertise on that listing. We can expect CoStar's marketing department to spend some serious cash to let U.S. consumers know all about it in 2024.

Another thing that Homes.com is proud of is the data around its listings. The portal is engaged in what increasingly looks like an arms race for richer data around homes and neighbourhoods.

Although Florance recently claimed to have "a thousand folks" employed collecting the rich data going into Homes.com, his firm already had a head start on that front. CoStar knows the U.S. market better than just about any company and operates a market-leading data intelligence service. It is also the leader in commercial real estate marketing and multifamily rentals marketing. CoStar can and will bring its expertise and network to bear in making Homes.com a success.

External factors may play a big role in deciding if Homes.com can challenge Zillow as well. There is currently a potential 'black swan' event looming over the U.S. residential sales market that could radically change how portals monetise their services.

“When all the cards get thrown up in the air and everything changes, that’s when new entrants emerge, and new disruptors emerge. And that’s very much what CoStar is trying to be.” Zillow co-founder and former CEO, Spencer Rascoff at the Inman Connect conference in 2022.

The issue—at the crux of an avalanche of lawsuits making their way through the court—is how agents get paid. There is a possibility that the government may intervene to ban or change so-called 'cooperative compensation' which could severely impact the buyers' agents that Zillow and Realtor.com make most of their revenue from.

If this were to happen there would be one very clear winner—the one portal that monetises listing agents rather than buying agents. The potential upside of the lawsuits looms so large over the discourse around CoStar and Homes.com that one brave journalist even went as far as to ask Andy Florance if his company was involved in any behind-the-scenes machinations.

Most of the arguments for why Homes.com might succeed against Zillow still have the word 'if' in front of them. One thing that is not conditional is the brand power of the companies that CoStar is taking on in the U.S. market.

Realtor.com is owned by one of the biggest media companies in the world. The portal's newly appointed CEO, David Eales made plain Newscorp's intention not to let its market position slip recently when he told the media the one-word mandate his bosses had given him on taking the job—'grow'.

"Of course we don’t want to be number two. We were number one. We predate Google in the digital industry. We were created in 1995. We are the original listings site. We were number one for many years. Something happened where Zillow took that crown off us, and I want it back.” Realtor.com CEO, David Eales at the Inman Connect conference in 2023.

As for Zillow, any brand that gets its own Saturday Night Live skit is going to be almost impossible to erase from the nation's cultural imagination.

Even if Homes.com can surpass its competitors' branding moats, there are questions about its monetization model.

Expecting listing agents to pay for increased visibility on your website might be tried and tested by portals in other markets and it may be the way that the multifamily rentals market in the U.S. works, but agents engaged in residential sales have never really been asked to cough up money for exposure before. Will they fall into line and pay up or just feast on free leads?

As the third most popular British property portal, the thing that OnTheMarket has always needed the most is brand awareness and traffic.

Like many portals around the world whose traffic numbers are lower than their rivals', OnTheMarket's PR line has been that its audience is more engaged and more likely to convert to high-quality leads than that of its competitors. It's a line that only goes so far.

While it might convince some agents to list on OnTheMarket, it won't convince them not to list on Rightmove. The talk of high-intent users doesn't make it into living rooms where agents are having conversations with the most important stakeholders in any property sale, vendors.

Anyone selling property in the UK will want to see their listing on Rightmove because Rightmove is where the traffic is. OnTheMarket will fail if it can't change that.

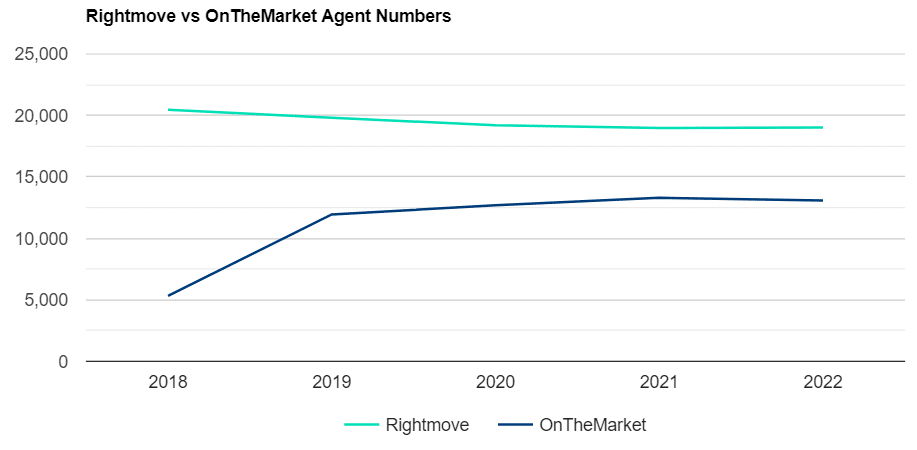

The portal is in the classic marketplace chicken or egg situation where it needs more listings to attract traffic which in turn attracts more agents and their inventory. But to get that traffic it needs more listings and better coverage. The last time both portals revealed their numbers, Rightmove had around 6,000 more agencies listing on its website than OnTheMarket which has had to pull out of Northern Ireland entirely due to a lack of listings coverage.

Despite the challenges ahead, there is no shortage of optimism and goodwill towards the portal and its chances among the agent community. The portal and its likeable boss Tebb have done a very good job of positioning OnTheMarket as the agent-friendly antithesis of Rightmove.

"We’re likely to see shifts in pricing, offerings, and strategies within the industry, and I can see Rightmove struggling to maintain its position as the most dominant online property portal." Paul Smith, Executive Chairman of national agency group Spicerhaart writing in the ageny-facing publication Property Industry Eye.

British agents' collective dislike of Rightmove helps OnTheMarket but it won't turn the tide. Even on rare occasions when the outrage has brought agents together, as it did in 2020 with the SayNoToRightmove campaign, it's never been enough to truly make any dent in Rightmove's dominance.

The only thing that has changed in the UK portal landscape since CoStar's buyout is OnTheMarket's marketing budget. Although it does own some commercial portals in Europe, CoStar doesn't have a powerful network of other portals or media outlets with which to back its new acquisition like it does at home. It has advice and it has money—£46.5 million of it in the first year with more inevitably to follow.

When OnTheMarket adopted its controversial and ill-fated 'one other portal' policy in 2018, the portal that lost out on listings was not the market leader but rather, Zoopla. That suggests that the main victim of OnTheMarket's new sales and marketing war chest is likely to be the number two portal rather than the market leader.

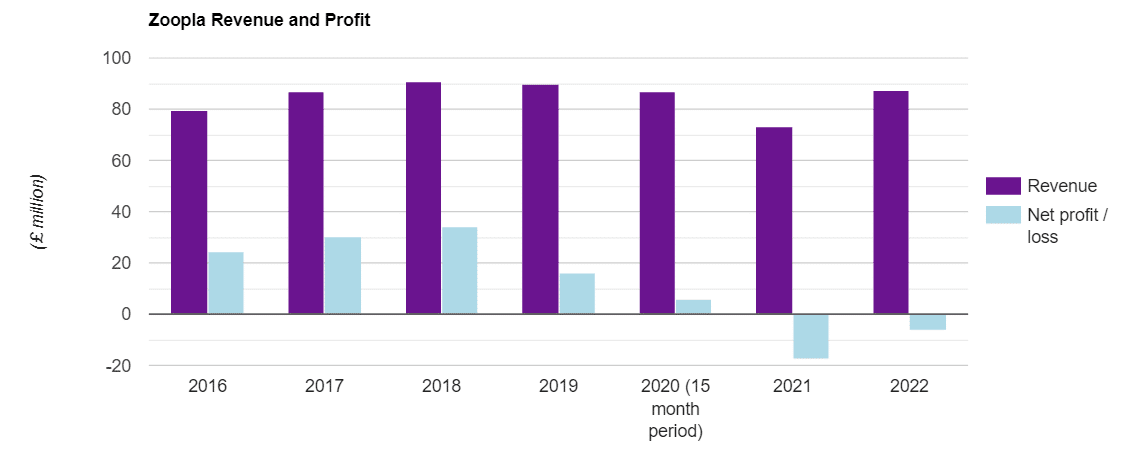

Zoola has, financially at least, been treading water for some time. One scenario that might be playing out in Andy Florance's head is one in which OnTheMarket dents Zoopla's market share to the point where its U.S. private equity firm owner Silverlake considers a reduced sale price. If consolidated, Zoopla and OnTheMarket would be a formidable opponent for Rightmove to have to deal with.

Equally, there is a scenario where CoStar fails to transfer its success across the Atlantic, can't find other attractive acquisition assets to support its mission and goes home with its tail between its legs.

The history of the real estate portal industry has a lot more examples of cross-border failures than successes and some such as the AIM Group's Principal, Johnathan Turpin think that Florance and CoStar are "underestimating the challenges" of competing in a European environment.

Homes.com would seem to have a decent chance of becoming a very profitable enterprise but taking down Zillow would be a shock.

The portal has a great point of difference for both agents and consumers, a massive marketing budget, great data to generate traffic with, significant market expertise, a network of adjacent assets and even a great domain name. That's all before we consider the 'what ifs' from a potential change to cooperative compensation.

American agents might be new to them but the type of visibility boost and branding products that are ubiquitous in other countries are making their way into the U.S. market. If the quality traffic is there, agents will pay up.

As for OnTheMarket, the formerly agent-owned portal has a puncher's chance against its big green rival but until it has a good reason why the British public would use its website instead of Rightmove's, its marketing budget won't make a dent.

We can probably expect the portal to double down on its 'Only With Us' initiative that encourages agents to list on OnTheMarket 24 hours or more before listing the property on Rightmove and Zoopla.

Tebb told Online Marketplaces in 2022 that 'Only With Us' listings represented between 4% and 7% of OnTheMarket's total inventory. If the portal is serious about de-throning Rightmove this percentage will be among the most important metrics on the CEO's dashboard in 2024.

For now, it looks like OnTheMarket is retaining the goodwill of the British agent community. Just this week news emerged of a deal with major agency group Leaders Romans who are dropping Zoopla to list on OnTheMarket.

It remains to be seen though how long a portal owned by a hard-nosed American company with 50 straight quarters of double-digit revenue growth can keep its customers on its side.