Looking back at the talking points from Property Portal Watch 2010 it seems that classifieds aggregators caused a stir in the real estate portal industry when they first sprang up.

Real estate marketplaces didn't know whether they were a threat, an ally or both at the same time.

Fifteen years or so later and now it seems like time might be up for aggregators—their business model deemed an inessential middleman by the market and their USP eroded on one side by savvy portals and on the other by Google's relentless drive to eliminate click-throughs.

Unlike real estate verticals like Zillow or Rightmove, aggregators like Trovit and Mitula are hardly household names. So what are these businesses and what is their value proposition?

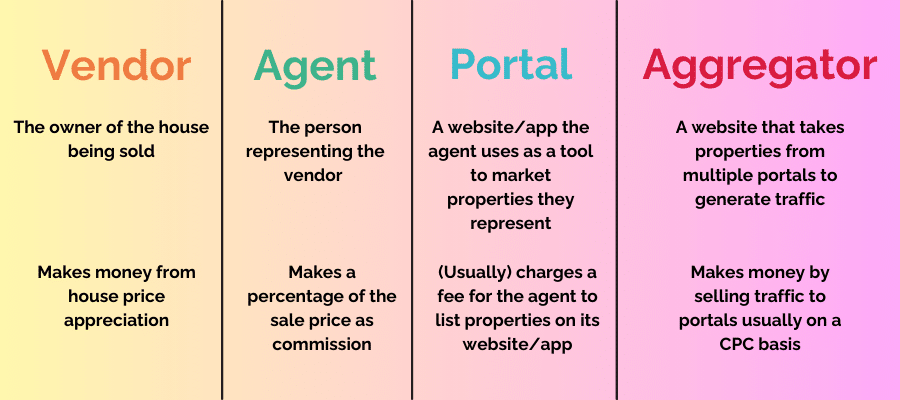

Often we see the likes of Zillow and Realtor.com being referred to as 'aggregators' but the businesses we're talking about here sit one level further away from the transaction.

Whereas portals typically take listings from most of the agents in their market via the agents' CRM software, aggregators will take listings from portals via XML feeds. If they can't convince portals to build (and, importantly, maintain) an XML feed for them, they will often just scrape the listings directly from portal websites.

Once it has the listings from all the portals in a market, an aggregator will get to work building results pages that outrank the portals' pages on Google, especially for more complicated 'long-tail' search terms. The idea is that because the aggregator has more listings than any individual portal and it has set up its SEO specifically for long-tail searches, it can attract a significant volume of Google searchers to its results pages.

A user might search Google for "3 bedroom houses for rent with double garage and a garden in Bristol". In an ideal scenario for the aggregator the user would click from Google to the aggregator at the top of Google's results, then they'd click from the aggregator to the portal where they'd fill in a form to be connected with the agent listing the property.

From Google to an aggregator to a portal to an agent. You can see how the aggregator's position as a middleman was always a precarious one but they've been around for a long time and made a lot of money acting as a source of 'extra' traffic for portals.

Perhaps the first really successful aggregator was Trovit. Launched in 2007 the Barcelona-based company found success early on and within its first ten years of operation had expanded to more than 50 countries and been acquired by the Japanese firm Lifull for €80 million. It also inspired a copycat...

Madrid-based Mitula was founded in 2009 with the same business model and expansion plans. It was a bootstrapped business that would go on to acquire competitors Nestoria and Nuroa and be listed on the Australian stock exchange before also being acquired by Lifull.

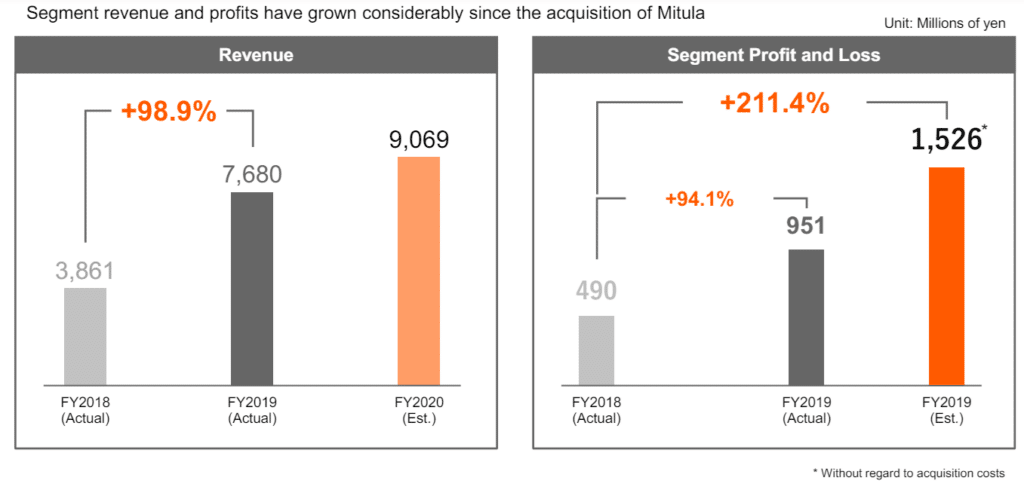

By 2018 most of the real estate aggregators (Trovit, Mitula, Nestoria and Nuroa) were consolidated under the umbrella of 'Lifull Connect' and were making decent money. In 2019 Lifull's aggregation business* generated ¥ 7,680 million (almost $50 million at today's exchange rate) at a 12% net profit margin.

Source: Lifull Earnings Presentation 2019.

Source: Lifull Earnings Presentation 2019.

Tech giants were taking notes. By 2020 Bing had snuck itself into the real estate classifieds game with the unannounced launch of Bing Real Estate, a service which looked very similar to that of Mitula and Trovit.

So aggregators seemed to be doing good business before the pandemic but recently they've not been doing so well...

Rubrikk Group, a Norway-based aggregator operator, announced at the end of May that it was ceasing operations after 16 years. and a few days later Bing's real estate aggregation service in the United States was effectively wiped out as Zillow and other portals insisted the tech giant remove their listings.

As for Lifull's aggregators, they have been on a steady decline for some time with the company having started to move the strategy of its 'Overseas' business away from aggregation and towards transactions via the acquisition of portal player Lamudi Mexico and the Thai brokerage FazWaz.

Above: Acquisitions and divestments in its Overseas segment mask the decline in revenue from Lifull's aggregators over the last few years

Reading between the lines, it doesn't look great for Lifull Connect's aggregators. During the worst of the pandemic, they suffered from portals tightening their belts, but the problem is that things haven't really picked up since.

In its 2023 shareholder report, Lifull admitted that CPC revenue from aggregation was down 19% year-on-year and revealed that it had sacked the management of its Overseas division. The man now in charge of overseeing the segment (Kiyoshi Shishido) is the company's former external auditor—an appointment which suggests battening down the hatches rather than investing for growth.

Then Q1 saw "lower profit YoY due to lower revenue in aggregation sites and one-off costs" and Q2 saw aggregation traffic down 33% year-on-year. It would be fair to say that the business is in need of a tailwind, some fresh investment, a change of tack or all three.

Above: Simon Baker and Edmund Keith discuss the future of aggregators with Rubrikk CEO, Adil Osmani on The PPW Podcast

As for Bing Real Estate, it has been decimated in its home market but is still operational in Canada (where, interestingly, it still had Zillow listings as of the 10th of June) and ten other international markets.

The faceless service seems to be selling some ad space on its detail pages but doesn't necessarily have lucrative CPC agreements with portals.**

The search giant may instead be using its aggregators just for lead generation for its rental management business which invites landlords to market their listings, screen tenants and deal with payments through its platform.

That pivoting away from charging portals on a CPC basis may be the saviour of these businesses. Former Mitula Group Chairman, Simon Baker believes that there is still a future for aggregators if they can link their leads to portals or brokerages they own (as Lifull Connect has done in Thailand with the acquisition of FazWaz) or if they're smart about the markets and segments they go after.

"I think you have to be smart about the segments you go after. And for me, the segment I love most is the new development segment. Because I remove one part of the problem, which is I don't have to deal with a home seller... and you probably get a higher commission, right? You can get five percent."

As for Rubrikk's CEO, Osmani thinks that the value of real estate aggregators going forward lies in the data they collect rather than the clicks and leads they generate.

"Imagine that you have all the ads in the market, let's say for example Germany, right? Because you get the feeds from ImmoScout and Immowelt and the others. Now you can understand by looking at advertising time, what is moving in which markets and how fast and at what seasons, right? If you package that data you can actually sell it back to the portals to the agents and give them some real-time intelligence on what goods are moving right now in your market."

* In 2019 Lifull's 'Overseas' segment did not solely consist of aggregators, it also included a few minor portals.

** Both Zoopla and OnTheMarket told us that they do not have commercial agreements with Bing. Both Immobiliare in Italy and REA India told us that they pass a feed to Bing Real Estate but did not specify if the relationship was commercial in nature. We are awaiting responses from other major portals that Bing takes listings from and will update as and when we receive a response.