Through the course of 2021 and 2022, several real estate portal operating companies took the plunge and went public. Every company going through the stress of floating on the market does so because it backs itself to grow.

All of the companies in that cohort have now released meaningful results since their IPOs and we've been going through the numbers and comparing them to the ambitions each company declared in their prospectus back when everything seemed possible.

Before it floated on the Stockholm Nasdaq back in April 2021, Swedish market-leading real estate portal Hemnet wasn't making big claims about future growth. The company's prospectus was long on potential and opportunity but short on specific targets.

The only meaningful mention of objectives came on page 59 where the company said it was aiming for between 15-20% revenue growth and an Adjusted EBITDA margin of between 45-50%.

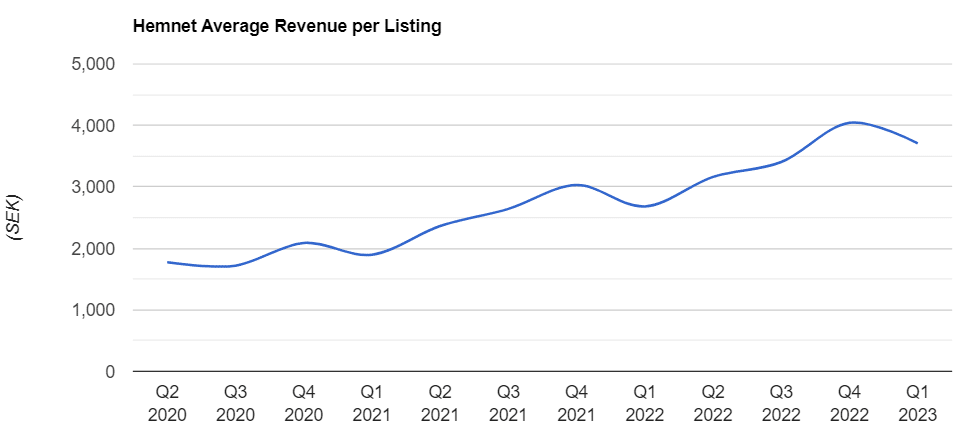

In 2020 the company made SEK 544 million ($50m) in revenue which went up 34% to SEK 728 million in 2021. In 2022 the company saw revenue grow 22% year-on-year to stand at SEK 889 million. In terms of profit margins, Hemnet operated at a 49% Adjusted EBITDA margin in 2021 and that figure increased to 50% in 2022.

So we can say that Hemnet has so far exceeded what its management aimed for in the company's IPO prospectus.

All of those healthy numbers have been driven by price increases and depth penetration which has ramped up since the IPO. Sweden's housing market sees vendors pay for marketing, a situation which has benefitted Hemnet greatly as the country's dominant marketing platform.

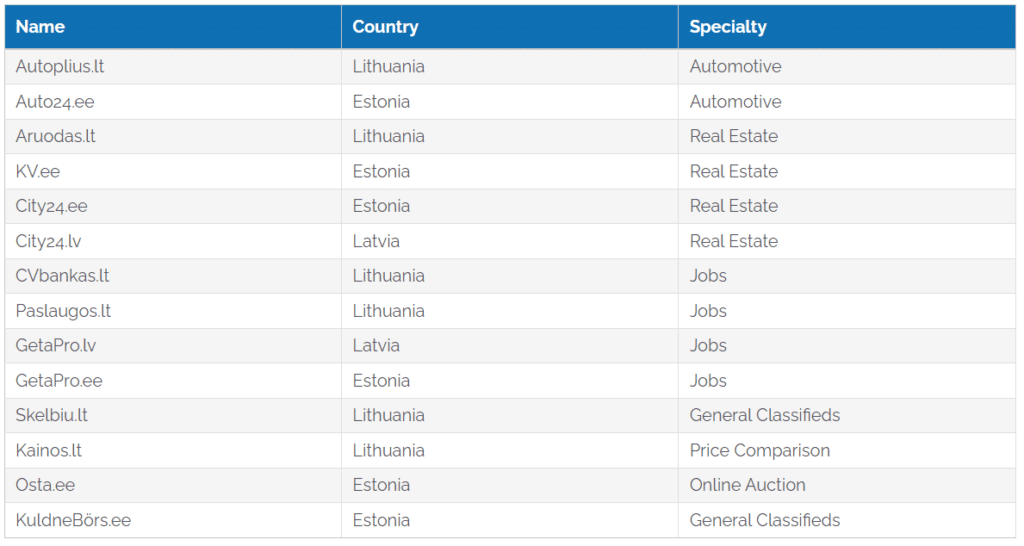

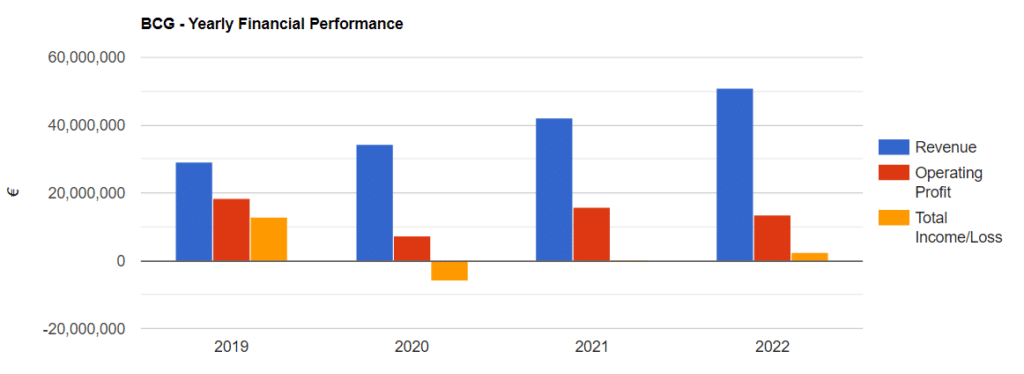

Headquartered in Lithuania, BCG is the only real game in town when it comes to online classifieds in the Baltic countries owning market leaders in its home market as well as neighbouring Estonia and Latvia.

The company floated on the London Stock Exchange in the summer of 2021 with its Directors openly targeting revenue growth of 15% in the IPO prospectus.

In the first full financial year since floating BCG generated revenue of €51 million, which was around 5% above the target. The company also reported positive results for the six months that ended October 31st 2022 where, again, revenue growth was up more than 15%.

While BCG's management didn't openly state any aims around profitability prior to the IPO, the company did manage to bring its bottom line back into the black for the year ended April 30th 2022 after two tough years.

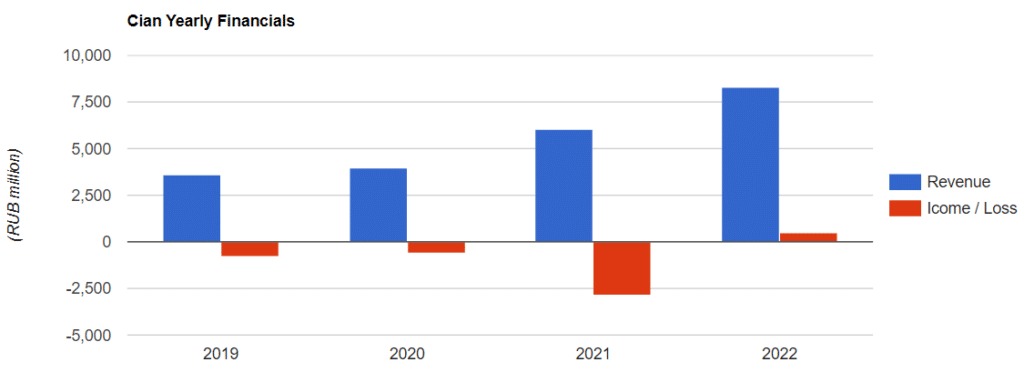

When it floated on the NYSE in November 2021, the management at Russian market leader Cian would have been forgiven for thinking that the worst was behind them.

They had recently restarted generating revenue in several lucrative regions after pausing all monetisation in light of the COVID-19 pandemic and, despite net losses, the company's EBITDA margin was heading in the right direction.

Then Russia invaded Ukraine and all bets were off. Despite being technically located in Cyprus, Cian was kicked off NYSE and today only trades on the Moscow Exchange.

In its prospectus, Cian predicted a compound annual growth rate of 27% between 2021 and 2025 for its core business.

Despite the country it operates in being at war, Cian managed to deliver on that prediction generating 8,266 million Rubles ($103 million) in 2022, a 37% increase on its 2021 revenue.

That growth has been kept up as well. The company's recent Q1 results reported 39% year-on-year revenue growth driven by its core business.

The portal has been benefitting from the increased demand for real estate among wealthy Russians as other avenues of investment become more risky or even illegal.

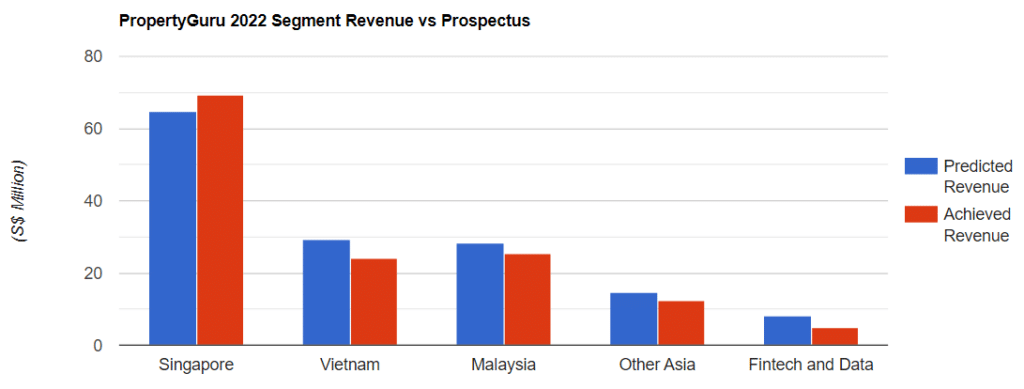

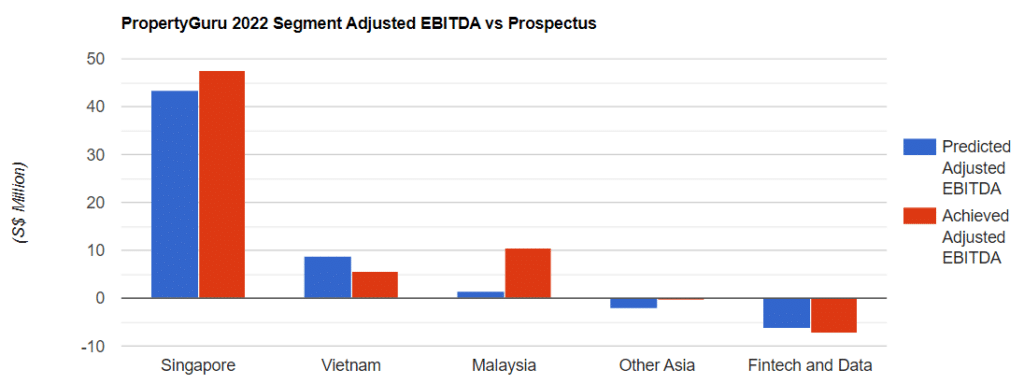

Before it floated on the New York Stock Exchange in March 2022, PropertyGuru was bold in providing clear revenue and profit predictions not only for the business as a whole but also for each operating segment.

PropertyGuru's home market of Singapore with its property-obsessed population and large agent marketing budgets was always likely to be the star of the show and that's how it has proved.

The predictions clearly didn't take into account the impact of the deal that PropertyGuru made to buy out its main competitor in Malaysia, iProperty in May 2021.

The Malaysian Adjusted EBITDA boost aside, PropertyGuru has largely fallen short of the outlook forecast it made in its prospectus.

Obviously, these businesses can't control the stock market and so the graph below is perhaps a little unfair. We thought we'd compare each portal company's current share price at the time of writing (25/05/2023) with the price each floated at.

While Hemnet's value has soared, shares in Baltic Classifieds Group are currently trading at around the same levels as when the company floated. Shares in PropertyGuru and Cian haven't fared so well with both currently trading significantly lower than their IPO prices.