Online real estate portals have been diversifying their businesses to get closer to the lucrative parts of the transaction for many years. The tactic of moving into revenue streams that are adjacent to property marketing is an important avenue of growth for many companies.

We analysed 55 of the biggest real estate portal companies in the world to assess over 180 of the products and services that they put out alongside their traditional property marketing services and answer some key questions around the subject...

The following is a summary of the report, we highly recommend viewing the full report which includes 8 key questions and answers around portals' adjacent revenue streams. If you're subscribed to our mailing list, a link to the report is already in your inbox.

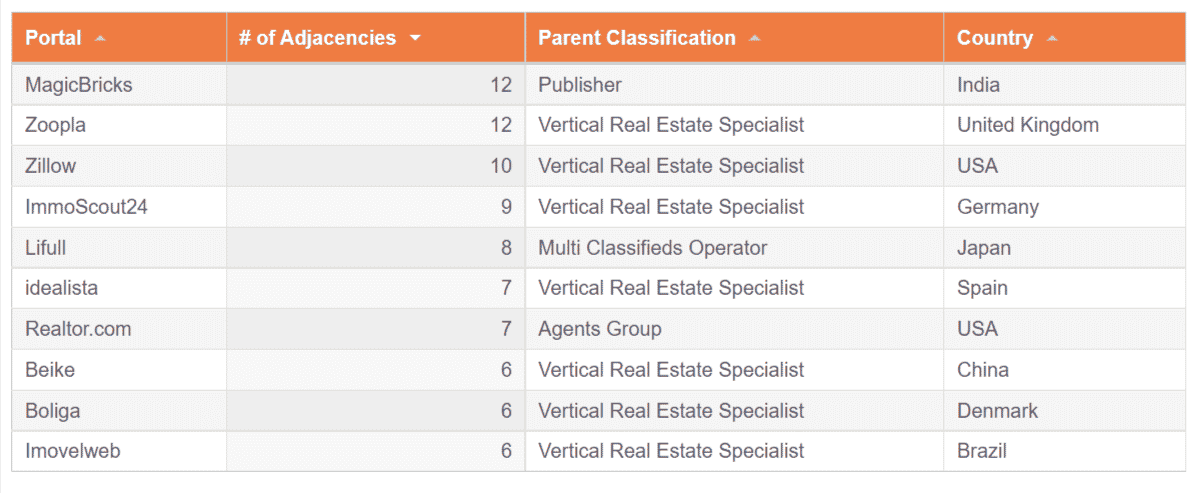

We went through every product that portal companies are tied to which are adjacent to real estate transactions. Whilst Zoopla may only be linked to many products through the ties its owner Silver Lake has to RVU, the British portal leads the way in terms of the number of adjacent products and services.

Also at the top is the Indian portal Magic Bricks which has an impressive range of lead generation products for all manner of services related to the home, from pest control to religious home-layout consultancy.

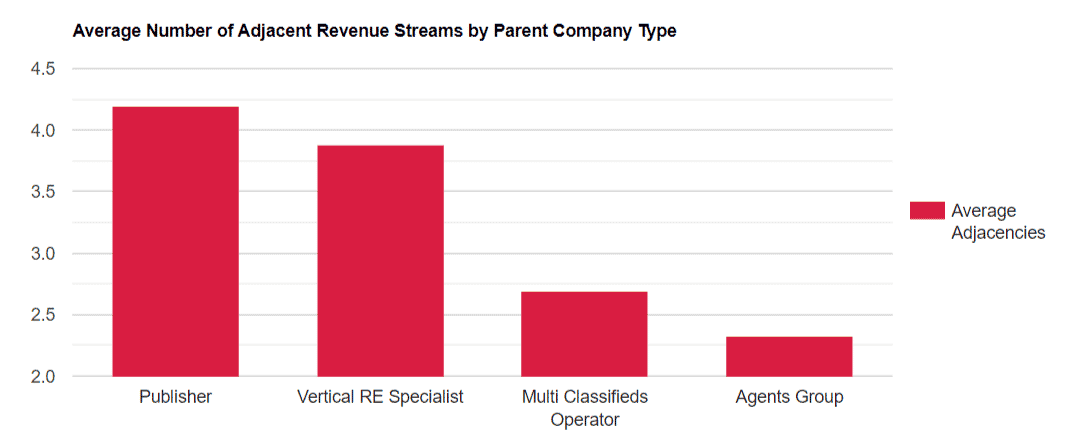

Real estate portal websites are owned and operated by all sorts of companies. We found that the companies that are leaning into revenue streams adjacent to property transactions the most are publishers - perhaps because by and large they are older companies and naturally have more ties with other industries.

As for the companies that are diversifying the least, unsurprisingly it's the portals owned by agents groups who don't want to rock the boat and risk taking any revenue that their agent members could be generating directly for themselves.

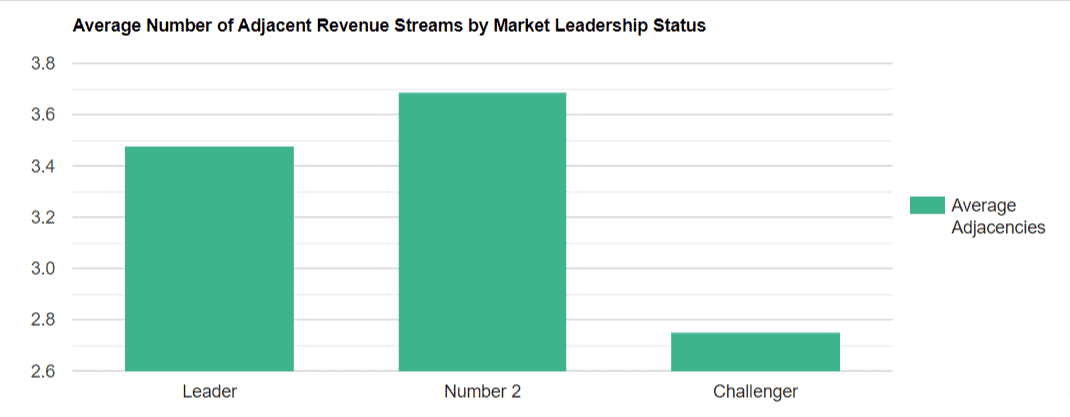

We also found that portals that are considered the #2 in their market are diversifying slightly more than market leaders on the whole. This makes sense as they often have as much technical capacity as market leaders but have less pricing power with their traditional listings products.

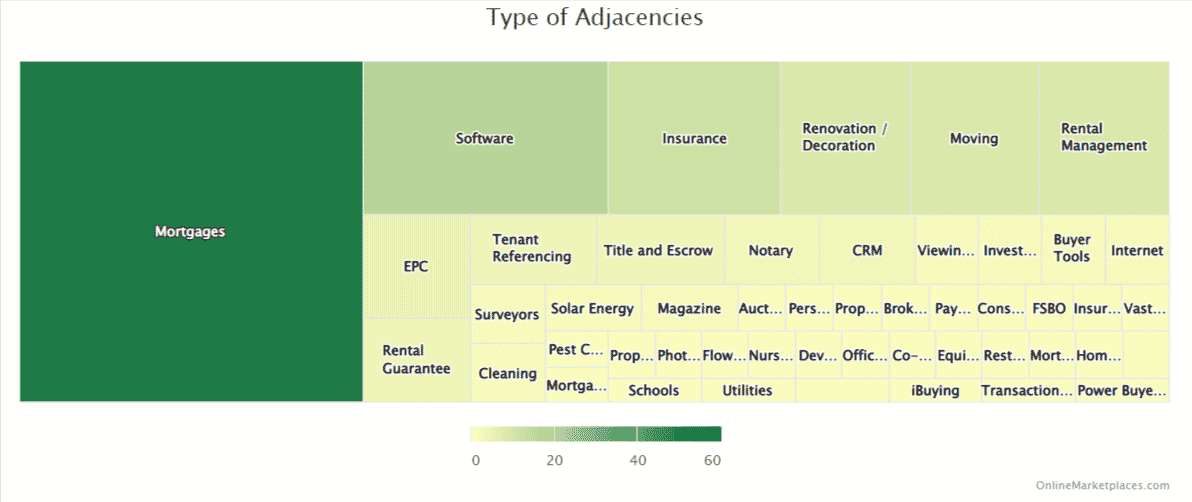

Mortgages are perhaps the closest and most relevant adjacent revenue stream for portals and they are almost all involved in them - though the vast majority we saw only have skin-deep lead generation products for third party mortgage lenders.

Software (mostly for agents) and insurance are the two other big industries that portals are getting involved in. We counted 50 different adjacent industries, aside from their traditional marketing role, that the leading 55 portals are involved in.

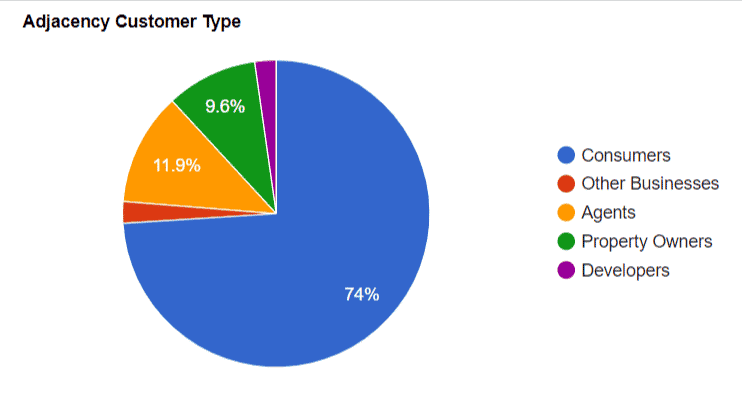

Unsurprisingly, almost three-quarters of the products we saw connected to real estate portals are marketed at consumers. This is, after all, the group that matters most in terms of branding and whose desire to shop around when moving home keeps the portals in business.

Over recent years we've seen portal companies release more products aimed at landlords and this segment represents around 10% of the products and services we saw.

Sign up to our weekly newsletter to access the full report and see more data around which portals have spent the most on M&A to get into adjacent revenue streams, the importance of these revenue streams to portal companies and the trend over time as well as how portal companies brand their adjacent services and products. If you subscribe to the Online Marketplaces' weekly newsletter, a link to the report will already be in your inbox.