The share price of KE Holdings went up yesterday despite its leading Chinese portal, Beike, reporting nearly $100 million in Net Loss in Q1 2022. Notable numbers from the unaudited financial results include:

The number of agents dropped 20% and service fee revenues dropped 28% YoY. The company also recorded an 18% drop in active monthly users.

Speaking to investors, Stanley Yongdong Peng, Chairman of the Board and Chief Executive Officer of Beike, said:

“In the first quarter, facing significant uncertainties arising from the outbreaks of COVID-19 variants in some cities and a soft macroeconomic outlook, we continued to strive forward with a determined focus on serving our customers.

“There is no doubt that we are being tested this year on multiple fronts, but we are resolute in our belief that the value we bring to our customers gives us an enduring competitive advantage in both good times and tough times.”

A number of KE’s operational metrics have also fallen since last quarter, including the number of agents and monthly active users:

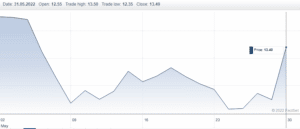

However, the share price still spiked by more than 10% after the company's results surpassed analyst expectations against more pessimistic forecasts—with the market pleased by the company’s damage limitation.

KE share prices recovered to $13.40 after dipping from a high of $14.51 at the start of May. Image credit: Hargreaves Lansdown

KE Holdings owns and operates the largest real estate portal site in China (Beike Zhaofang) as well as one of the country's most important brokerages (Lianjia). The company paid $1.2 billion to acquire the home renovation company Shengdu Home Renovations Co in July 2021 through which it has plans to 'touch every transaction in the home' for Chinese consumers.

The debt crisis surrounding China’s property giant Evergrande continues to undermine the real estate market overall with KE Holdings' rivals FangDD and Alibaba's real estate portal Leju reporting net losses of $178 million and $150 million for FY21 respectively. Real estate accounts for 25% of China’s GDP, so the property industry is closely observing whether Evergrande can start paying off its reported $300bn debt.