With the majority of publicly owned portals having already released their financial results for the first six months of the year, Online Marketplaces decided to have some fun.

From "Biggest Winners" to "Flattering to Deceive", We compared nine industry-leading portals from around the world and distributed seven awards. Here's what we found:

Despite middling revenue growth in comparison with bigger players, Hemnet is our biggest winner. The Swedish portal is enjoying life as a public company and making the most of its dominant market position. The Stockholm-based firm saw its most successful and profitable period yet since going public in April 2021.

Hemnet recorded the biggest y-o-y profit increase of all the portals we compared (37.3%) with profits of US$21.6m for the year.

Ceccilia Beck-Friis, CEO at Hemnet, said:

"One of Hemnet’s strengths is that our business is also well positioned for this type of market, as we are paid for each new listing rather than a completed property transaction."

Oh dear. KE Holdings (also known as Beike) probably wishes that 2022 hadn't happened. With disturbing losses of $377m for the year, the Chinese portal's negative y-oy profit change spiralled to an astonishing 212%, despite generating revenues of just over $4bn.

It has sucked to be a portal in China over the last two years. KE's competitor, FangDD released its own set of disappointing results this week. Nevertheless, KE Holdings is a powerhouse portal that is strong (and clever) enough to weather the storm and return to winning ways.

With net profits of $462m for the year, REA Group almost quadrupled the performance of the second-most profitable portal on this list— Germany's Scout24 ($120m)—and broke the A$1 billion revenue barrier.

Things are going well for REA Group—domestic profits keep going up and the overseas long play is going nicely with REA India's flagship portal Housing.com now established as the market leader in terms of traffic.

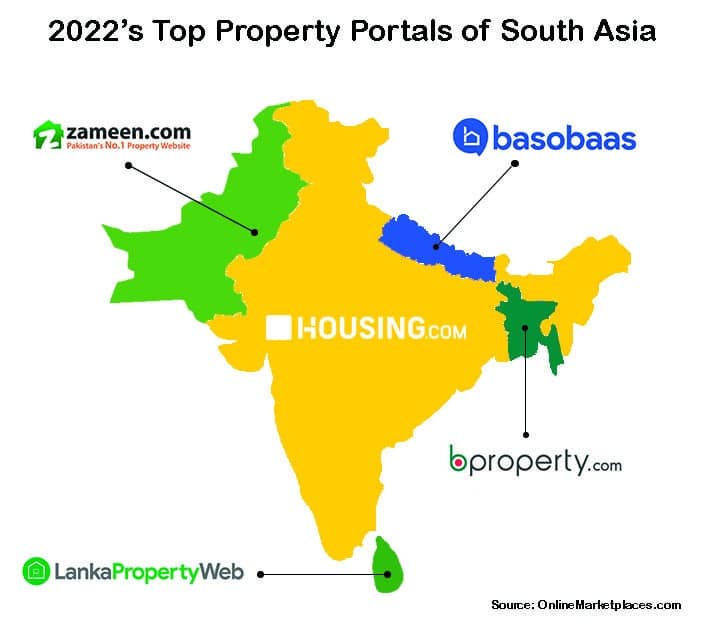

Leading Real Estate Portals of South Asia

An honourable mention goes to Domain, Australia's "second portal", which recorded more than respectable net profits of $83.7m.

After more than doubling its revenues from 2021, Zillow's $5.2bn revenues only show one side of the story.

Net profits of just $24m paint a more realistic picture—of the giant who tied his own shoelaces together, immediately fell over and is now just starting to get back to its feet.

Zillow's huge revenues have been funded by selling off the housing stock bought by its failed iBuying business, which explains its comparatively small profits.

The company is banking on the 'housing super app' to take it back to the very top, but a cooling market needs to be navigated first.

The only category with multiple winners.

If no news is good news, Rightmove is receiving plenty of greetings cards as it ups the prices of its core agent advertising business. Revenues and profits grew by 6% and 8% respectively for the year, with net profits of $114m from $185m revenue.

Similarly, CoStar in the United States had solid y-o-y revenue (11.7%) and profit growth (10.8%). There has been little news of CoStar's Homes.com portal which it is expected to launch 'soon' to challenge Zillow's residential real estate crown but as long as the numbers go up elsewhere, that can wait.

In Australia, Domain recorded excellent YoY revenue (27.70%) and profit growth (22%) for the Australian financial year.

Revenues grew by $13m for the operator behind the majority of south Asia's market-leading portals, an impressive 42.9% YoY increase.

Interestingly, adjusted EBITDA losses of $3.5m in 2021 turned into profits of $2.8m in 2022, an incredible uptick that makes our graphs look silly—and well worthy of an award.

Scout24 ($120m) pipped Rightmove ($114m) as the most profitable portal operator in Europe. The German business switched up its business model a couple of years back and is starting to see the rewards for its patience.

Revenues hit $217m, a healthy 14% increase YoY.