We're revisiting the infographic series we did in late 2020 looking at the top real estate portals around the world by traffic on Similarweb.

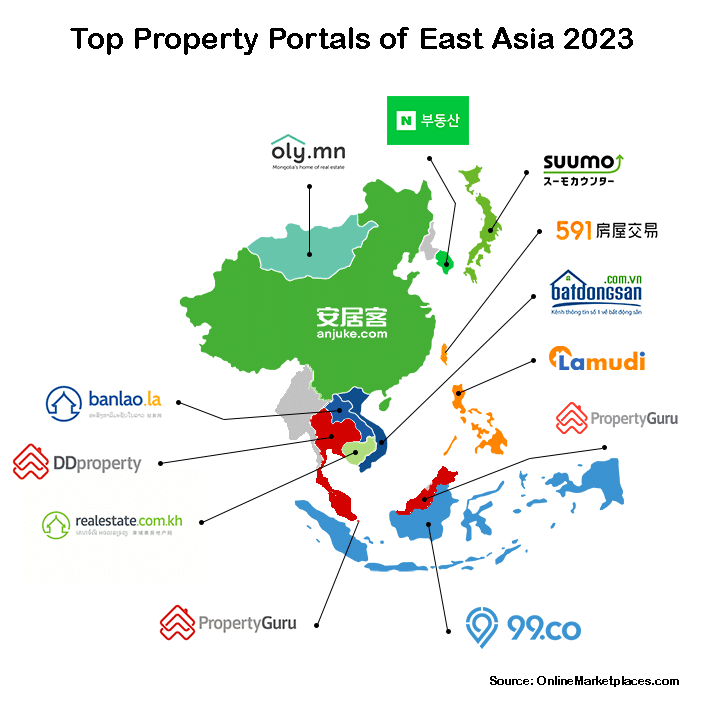

East Asia is a region that has generated a lot of headlines in the portal industry over the last year. Many countries in the region are experiencing an online revolution with rising numbers of internet users, a burgeoning middle class and an influx of investment capital.

Increasingly, the rewards for market-leading property portals in the region are becoming more and more attractive as the market becomes more sophisticated.

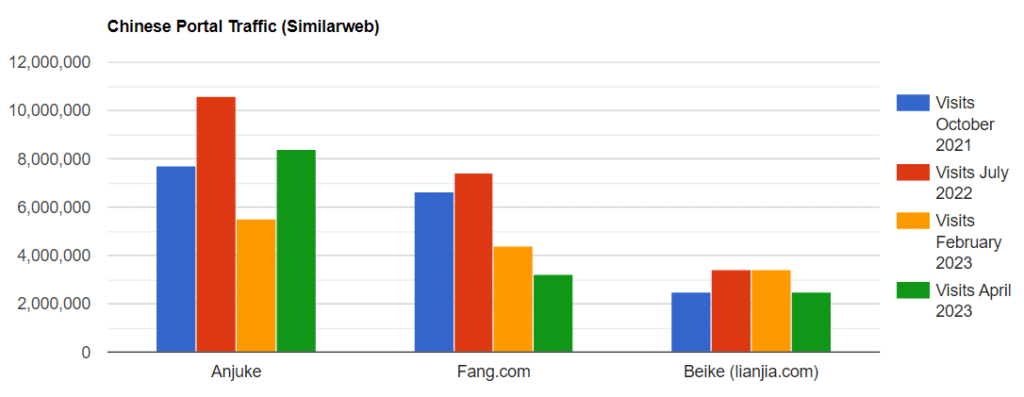

Similarweb has Anjuke coming out on top over eternal rival Fang.com. Another Chinese online real estate marketplace, Beike (KE) which also owns and operates the country's largest brokerage (Lianjia) is also very prominent in the market.

It is worth noting that the stats from Similarweb are way off what both Anjuke (67 million) and Beike (42 million) claimed in monthly mobile users in recent quarterly filings - nowhere near the numbers on Similarweb.

The property portal version of the Korean internet search giant Naver. The portal has been seeing over 12 million visits per month according to Similarweb, substantially down on the 15+ million it was seeing through most of 2020, but it's considered the #1 player. That said, mobile application traffic (which is harder to track) is a very important factor in the Korean market.

Other big portal companies in the market include Zigbang.com, Ziptoss.com, r114, hogangnono and Dongnae.

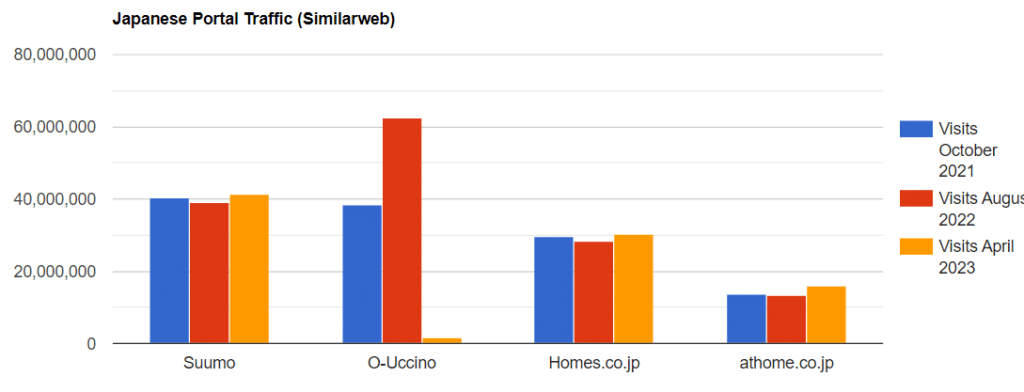

Just ahead of Lifull-owned homes.co.jp, Suumo is a market leader in Japan. The traffic for previous traffic leader O-Uccino seems to have dropped off a cliff since the last time we checked the stats.

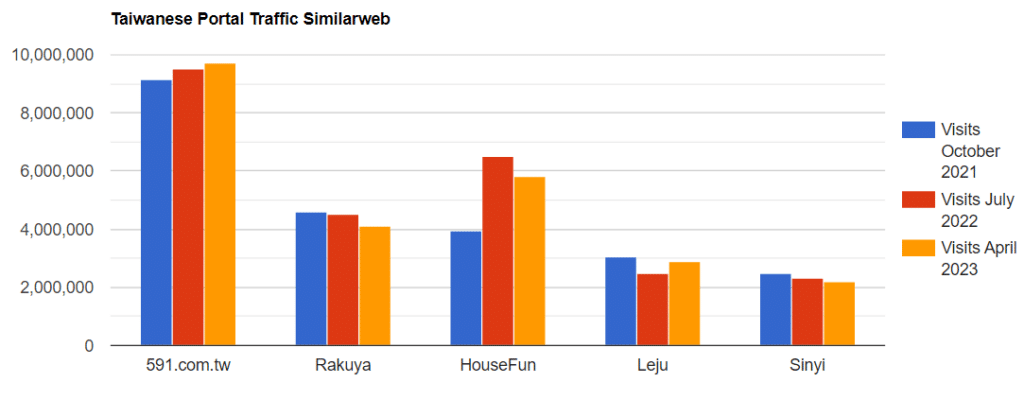

Apart from running the top property portal in Taiwan, 591’s parent company owns a host of portal and classifieds sites across the country and was formed as far back as 2007.

Other notable real estate portal's in Taiwan include Rakuya, HouseFun and Leju.

Another Asian portal backed by a portal conglomerate, Banlao is part of the Digital Classifieds Group. Although general classifieds site Yula.la gets a lot of traffic in the country, Banlao can be considered the top specialist portal.

Another portal from the Digital Classifieds Group portfolio after being bought out in 2015. The portal was the first of its kind in Cambodia after being founded by Moek Chenda in 2009.

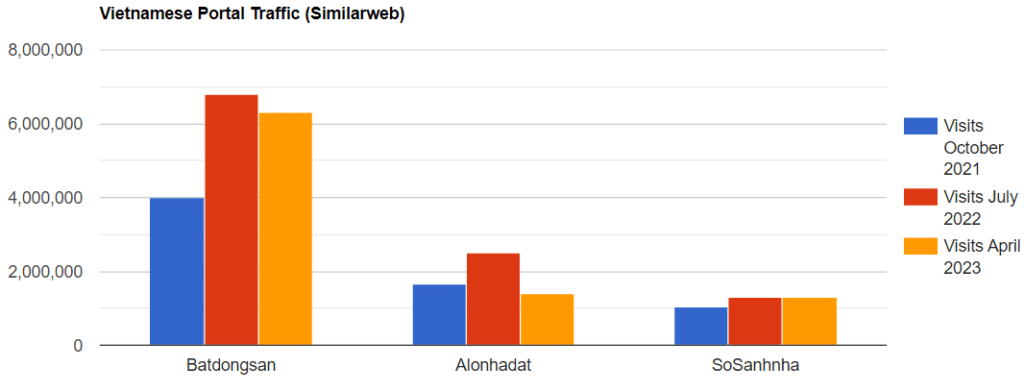

The leading property portal in Vietnam is part of the PropertyGuru Group. The company's about us page and Similarweb both give a traffic figure of 4 million monthly users, the corporate page says 8 million users. Whichever number it is, it makes Batdongsan #1 in Vietnam ahead of Alonhadat and SoSanhnha.

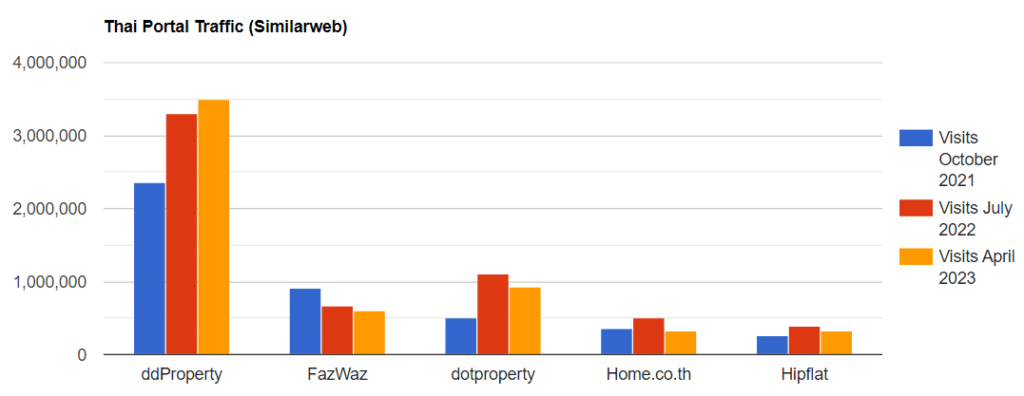

Another market in which PropertyGuru Group is winning. The group has been present in Thailand since 2011. There is a real proliferation of property portals in the Thai market and competition is provided by Fazwaz, Hipflat, dotproperty and others.

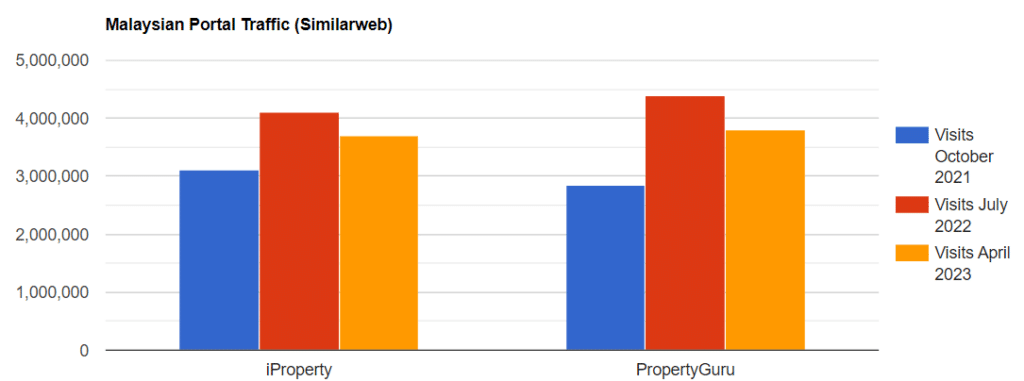

This one has been a bit of a moot point ever since PropertyGuru signed a momentous agreement to buy out iProperty. PropertyGuru has traditionally been stronger in and around Kuala Lumpur with iProperty stronger outside the capital.

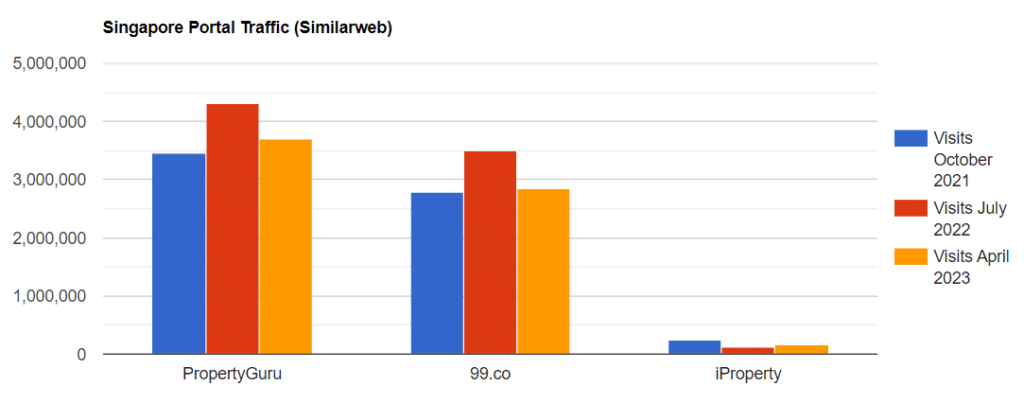

PropertyGuru comes out on top in its home market of Singapore according to Similarweb. Competition in the market comes from 99.co which no longer counts REA Group as a backer after the Australian portal giant was forced to divest from 99.co as part of a deal to sell iProperty to PropertyGuru.

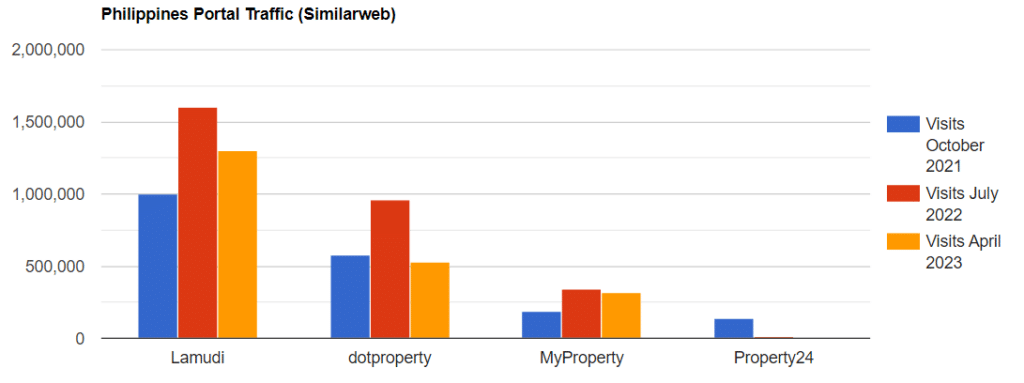

An eclectic mix of property portals here including South African (Naspers) owned Property24, Japanese (Lifull) owned dotproperty and Dubai owned (EMPG) Lamudi which beats the rest in terms of traffic according to SimilarWeb.

Another market in which iProperty and PropertyGuru battle it out against 99.co and the portal it acquired in 2015, RumahDijual. Here 99.co and its sister portal Rumah123 are the clear winners over PropertyGuru-owned Rumah.com and Rumahdijual.