There are 27 publicly traded companies that operate real estate portals around the world and all but one has released their results for 2022.

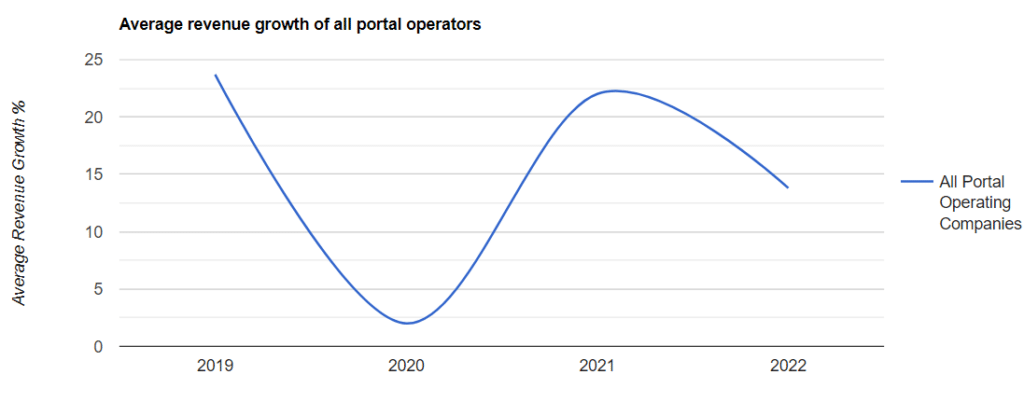

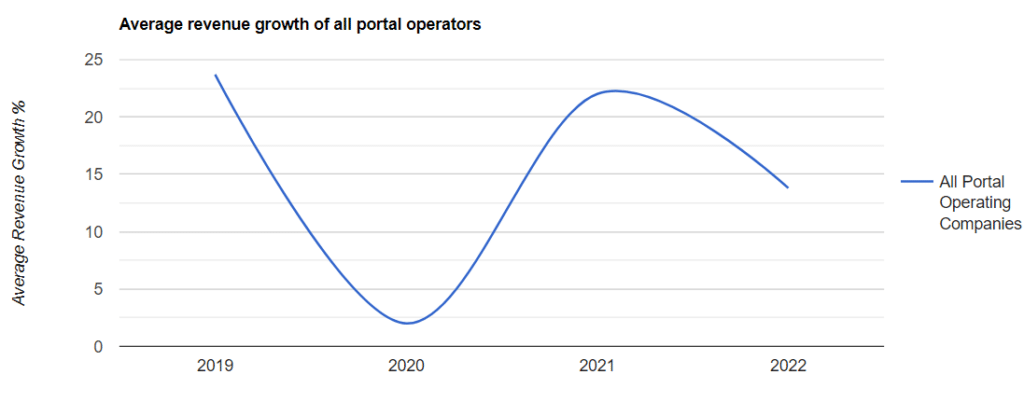

Before the pandemic, real estate portals were some of the most profitable businesses around. Most of them were hit pretty hard in 2020 but now it looks like real estate marketplace businesses are back to business as usual. Let's dig into real estate portal growth in 2022...

The average revenue growth of all portal operating companies was in double digits again (13.8%) after two years of pandemic-induced fluctuation.

- Being a leading real estate portal is still a great business even if there is a downturn and even if the market isn't hot on your stock

- The market perception of whether portals are doing well depends on whether they are considered advertising businesses, tech businesses or real estate businesses. All have different growth benchmarks.

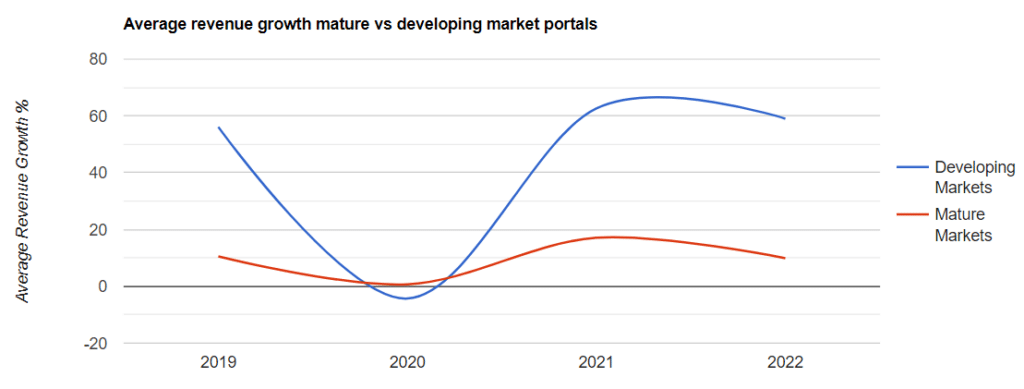

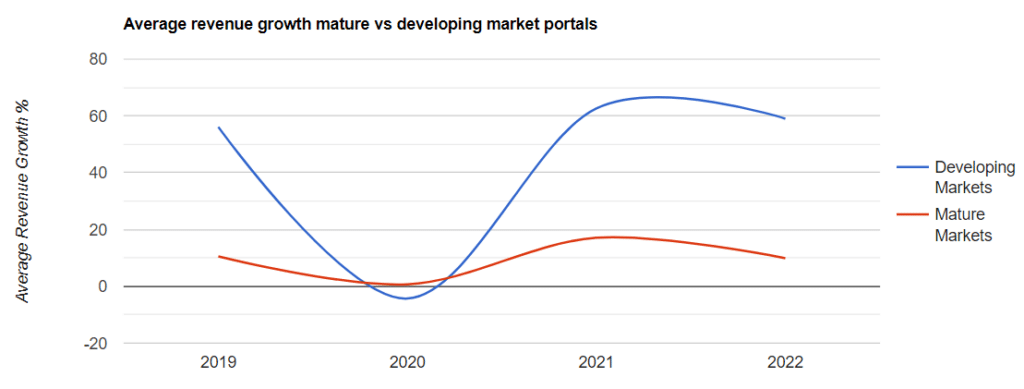

- Revenue growth in 2021 was inflated by the events of 2020, so 2022 was just getting back to normal for the likes of Rightmove and Hemnet that just run advertising businesses.

- Younger businesses, those in less mature markets and those investing heavily in adjacent revenue streams like PropertyGuru are seeing accelerated growth.

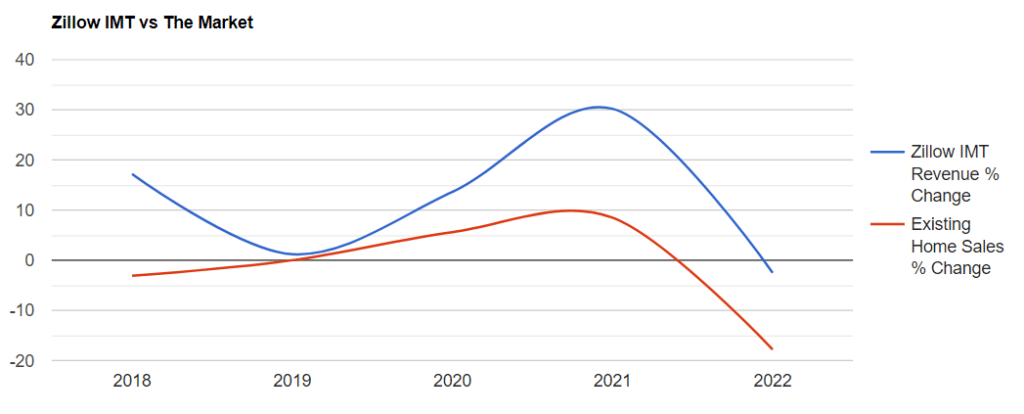

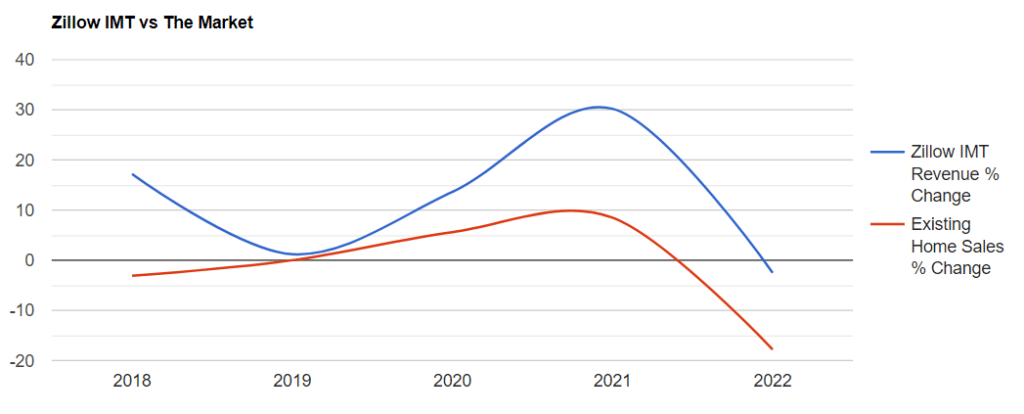

Portals are still beholden to the housing markets in which they operate even if they might like not to be. The narrative of scarce inventory, unaffordable deposits and inflation rates scaring off buyers was ubiquitous in 2022 with China and the US particularly impacted.

- As much as we say that their model is stuck in the past, portals that charge a flat subscription fee did better during the downturn. If your revenue is recurring and not directly linked to sales volumes, you'll survive market fluctuations but might need to change in the long run.

- Portals that saw negative revenue growth will say that they outperformed the market and they may be right (like Zillow's main IMT segment, below).

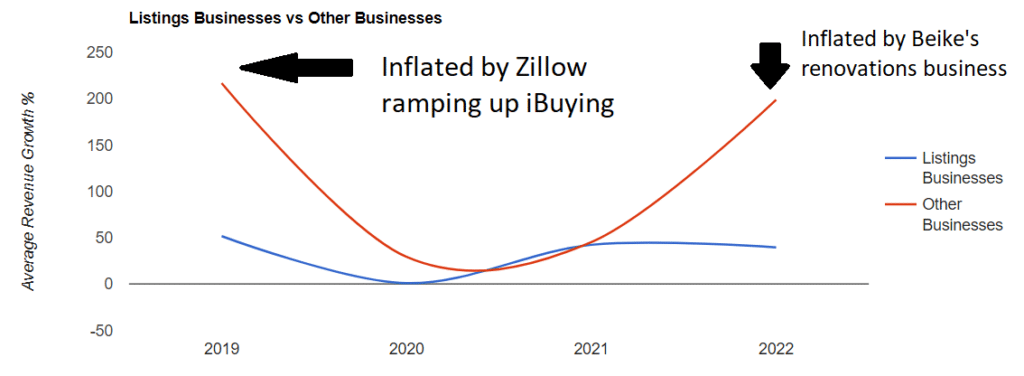

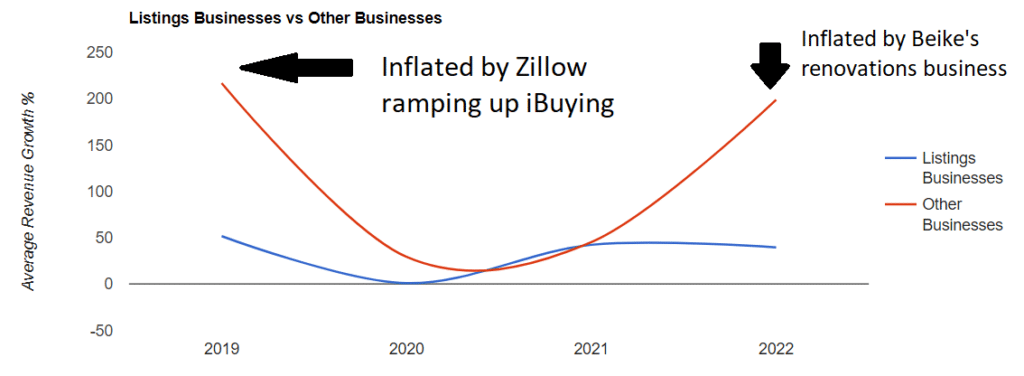

It's still too early to tell if portals have mitigated their upcoming 'ceiling hit moments'. Many portals in developed markets have started to hit the ceiling in terms of the number of agent customers they have and how much they can charge them for basic advertising services. The business lines that they've developed to get around this are seeing growth fuelled by a lot of investment.

- Most portals that break out the performance of their display advertising saw flat revenue growth for that business in 2022.

- A lot of the 'other' segments in reporting are still in the scaling phases and portals aren't brave enough to tell us their profit margins yet. The adjacent revenue streams that portals do report tend to be unprofitable with one or two notable exceptions.

- Portals continue to invest huge sums into adjacent revenue streams like mortgages and renovations creating disproportionate revenue growth.

The really exciting stuff is happening in developing markets away from the headlines. The lines between what those in mature markets call a portal and a brokerage are blurring more and more in developing markets.

- Most portals in developing markets don't declare their metrics so we can reasonably assume that the growth is greater than that shown in the chart below.

- The advertising model hasn't hit its ceiling in developing markets. Profit margins might be lower but real estate marketplace companies can get away with more because the market isn't as formal and the agents aren't as sophisticated and organised.