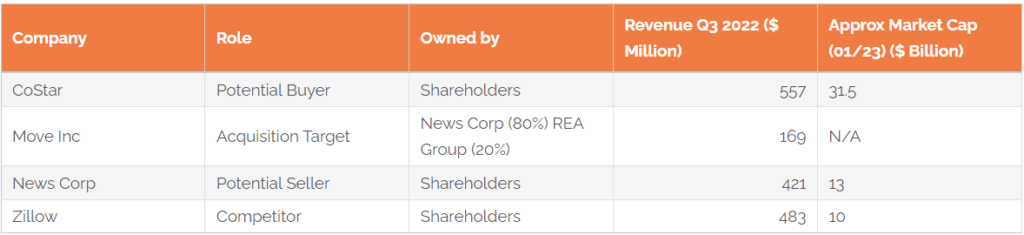

The news that CoStar Group is in talks to acquire Realtor.com's parent company Move Inc was confirmed by Australian portal company REA Group on Wednesday. A deal between the two would be worth around $3 billion according to Bloomberg. It's a figure which would represent the most ever paid for a pure real estate vertical marketplace.

It would also have some serious implications, not just for the vendors, agents and marketplaces operating in the U.S. but also further afield in Australia where News Corp's other real estate crown jewel REA Group operates.

Online Marketplaces has been reporting on the parties involved for over a decade. We've got everything you need to know about the possible implications of a CoStar deal for Move Inc.

Move Inc is the parent company of the U.S. real estate portal Realtor.com - competitor and perennial runner-up to Zillow in terms of traffic and revenue. Move is 80% owned by News Corp, one of two media conglomerates controlled by Rupert Murdoch and his son Lachlan. The other 20% of Move is controlled by REA Group, an Australian real estate portal operator which itself is majority owned (61%) by News Corp.

Realtor.com as a first mover (the domain has been a portal since 1996) which was backed by the industry should have been a clear market leader in the states. The story of the portal before it was bought out by News Corp in 2014 for $950 million is one of...

"dot-com mania and megabucks, mergers and acquisitions, hirings and firings, failed ventures and high-flying stock valuations, suspicious dealings and shady characters [and] phony financial statements".

The travails of the site's previous parent Homegate ultimately opened the door to competitors Zillow and Trulia. When Murdoch and News Corp were looking to the U.S. market to supercharge their Real Estate segment in 2014, rumour has it they were rebuffed by Zillow and held talks with Trulia before ultimately settling on Realtor.com.

Soon after buying Realtor.com the Australian tycoon went on to ask a conference full of U.S. realtors...

"What the hell does 'Zillow' mean? We know what 'realtor' means!"

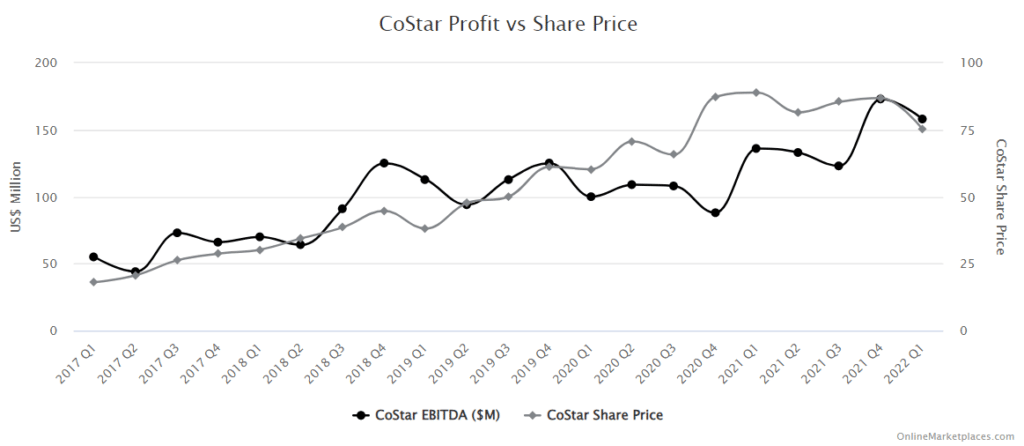

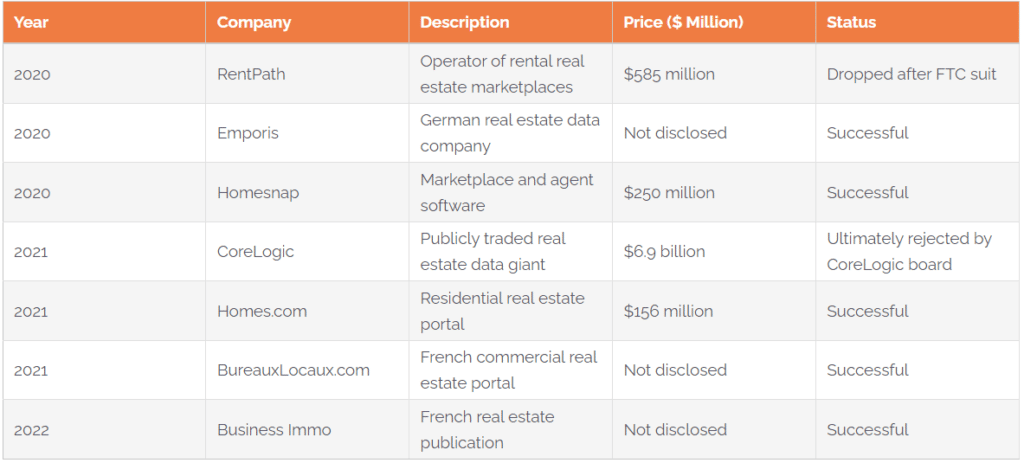

CoStar is a real estate juggernaut founded in 1987 by Andy Florance who remains CEO to this day. The company made its name in commercial real estate before going on to become a dominant force in residential rentals. In April 2021 the company made clear its intention to move into the residential sales sector by paying a reported $156 million for the Homes.com portal having already forked out $250m for Homesnap.

CoStar has a reputation as a company that puts a great emphasis on generating value for investors. It cranks out record revenue figures on a regular basis and its stock was recently selected for inclusion on the prestigious S&P 500 index.

In some former employees' opinions however, this comes at the cost of being a kind and understanding employer with several strong accusations having been levelled at management and, in particular, at Florance over the last few years.

While the press releases from both News Corp and REA Group pointed out that there was "no guarantee" of a transaction, the fact that high-stakes talks between publicly traded entities were admitted to at all suggests there is a desire on both sides.

The U.S. real estate industry seems to think the deal makes sense.

Brad Inman speculated that News Corp was putting Move in the shop window in a column published in March 2021. Since the news surfaced, Inman's publication has quoted Zillow co-founder Spencer Rascoff as saying that he was “not at all surprised" that CoStar was making an "obvious and predictable" move while Trulia co-founder Pete Flint said that the deal "makes total logical sense."

At the time of its last quarterly filings, CoStar had around $5 billion of dry powder in the bank with Florance telling analysts on a recent call that he was spending a lot of his time looking at potential acquisition targets.

CoStar is certainly not averse to using inorganic growth to move into new markets. The Washinton-based firm has regularly flexed its financial muscle over the last few years, but not always successfully.

The mooted $3 billion price tag, which was described by Spencer Rascoff as "a little low", is unlikely to put CoStar off.

What might kibosh any deal might be News Corp's seriousness in selling Move Inc or perhaps any objection from the zealous head of the Federal Trades Commission, Lina Khan.

There is also the potentially thorny issue of Realtor.com's business model and CoStar's attitude to it...

Perhaps the biggest change for Move Inc and for the Realtor.com portal if it were taken over by CoStar is the way it charges agents.

Over the last few years, Realtor.com has been a pioneer of what analyst Mike DelPrete termed 'next-gen-lead-gen'. Since its acquisition of OpCity in 2018 the portal has been generating and qualifying sales leads in return for a percentage, typically 35%, of agent commission.

This model represents an important and profitable shift away from the portal's more traditional business model and was recently estimated by DelPrete to represent around 30% of all income the portal makes from generating leads.

The issue here is that CoStar is, in public anyway, dead against this way of doing business with agents. Andy Florance made his feelings on portals earning a slice of agents' commission very clear in a recent interview with RISmedia...

"CoStar is not going to change its business model to get a portion of the commission... I’ve had plenty of time to take a commission; I’ve had plenty of time to do iBuying; I’ve had plenty of time to do a referral fee; I’ve had all kinds of time to do those things that people don’t like and we’ve chosen to never, ever do them."

Apart from the issue of its business model, any merger of Realtor.com staff with CoStar would likely see a lot of roles duplicated and lead to redundancies.

It would also bring Realtor.com staff under the management of a company in CoStar which has made headlines for its allegedly less-than-wonderful corporate culture - although management squeezing the lemon by any means necessary is not something completely alien to Move Inc.

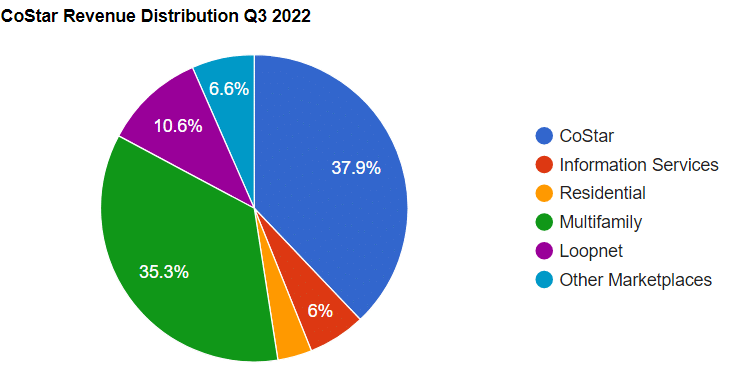

The short answer to that question is that by acquiring Move Inc CoStar would get an ideal shortcut into the world of residential real estate. It's a market with a lot of headroom!

As of its last public filing, CoStar made only 3.6% of its $557 million quarterly revenue from residential real estate. The deal would represent a fantastic opportunity to grow big enough to steal Zillow's crown or at least take a big slice of the $5 billion revenue pie that Zillow is aiming for by 2025.

Realtor.com is already generating over $700 million per year although there was a 6% year-on-year drop in revenue in the company's latest quarterlies (along with an 11% drop in traffic and a 32% drop in lead volumes).

Backed by a huge company like CoStar with the virtuous network effects from dominant rental portals Apartments.com and ForRent.com as well as leading commercial portals, Realtor's growth would surely return once incorporated.

For now, CoStar's nascent Residential division is generating around $20 million per quarter as the back end is built out ahead of a massive anticipated marketing push later in the year.

Those residential capabilities are mainly being built around CoStar's Homes.com portal domain as well as the Homesnap platform, an existing business that was bought out in 2020.

If a deal to buy Realtor.com does come to fruition there is the question of what happens to Homes.com and the investment in the "crazy projects" already underway to attract traffic to the domain. CoStar has been hiring "a thousand folk" to collect unique neighbourhood data to enrich content on Homes.com. Would this rich, SEO-friendly data find a home on Realtor.com?

Digital Real Estate Services is the most profitable of News Corp's six reporting segments. Move Inc may not be the jewel in that crown and may not be a market leader but it still represented 6.8% of total company revenues in the last quarterly filing.

Giving up a profitable business for a song ($3 billion isn't exactly paltry but has been described by some as surprisingly cheap) doesn't sound like something Rupert Murdoch would do, does it?

News Corp's statement on the matter made clear that it would need any potential deal to "optimise the value of its Digital Real Estate Services segment while strengthening Realtor.com’s competitive position in the market".

So could we see Murdoch and News Corp take a large shareholding in CoStar alongside a cash consideration and let fellow hard-nosed businessman Florance do the legwork? There is a recent precedent in the online classifieds industry...

When online classifieds operator Adevinta acquired eBay's classifieds division in 2020 the headline figure was an eye-watering $9,2 billion. In reality, the deal was structured much more like a merger than a buyout with eBay taking on 44% of existing Adevinta shares.

As for REA Group, it would be in line for 20% of any purchase price. Money that might be put towards an increasingly successful but expensive tilt at dominance in the Indian real estate market.

If News Corp is willing to sell Move Inc, there is a small chance that it might be open to offers for the 61% stake it owns in REA Group. The Australian portal operator is one of the most profitable in the world with a lot going for it. As a publicly traded entity, it has by and large fared much better than most of its peers.

A deal to sell its biggest rival to another rival with even more money and real estate nouse is ostensibly the last thing Zillow CEO Rich Barton would like to see in 2023.

A unified competitor with deep pockets, a pugnacious attitude and a large section of customers cheering for it is not what Zillow needs as it recovers financially from its iBuying misadventure.

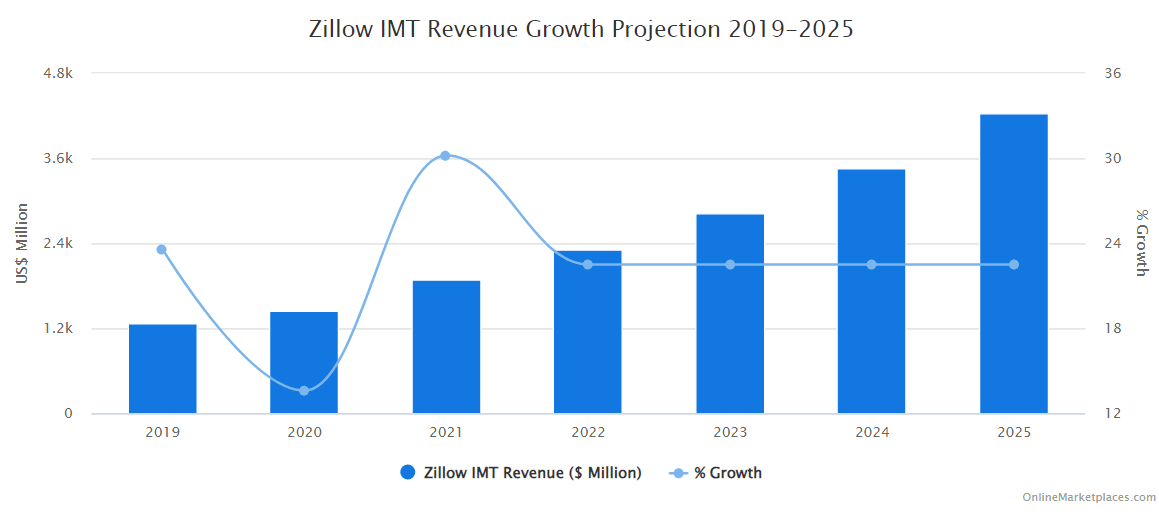

Betting against Zillow when it comes to marketing houses though would be foolhardy. The portal company is on a mission to generate "$5 billion in annual revenue and a 45% EBITDA margin by the end of 2025" and if it keeps up the yearly growth rate of its main IMT section, it might get there.

Barton is no doubt sat in Seattle insisting to his board that any CoStar - Move Inc deal brings an opportunity for Zillow. Fewer competitors usually means higher prices and if CoStar takes Realtor.com out of the commission share game, that just leaves Zillow for the agents that like the model.

Zillow's stated strategy over the next few years is to build and market what it calls a 'housing super app'. The idea behind the app is still somewhat nebulous but many of the services it will end up offering such as power buying alternatives may well not be in areas that CoStar, with its agent-central mantra, want to get involved in.

Ultimately Zillow will continue to do what it does in its own way with its model, its brand and its company culture distinguishing it from CoStar. And if Zillow absolutely has to pivot, it has shown in recent times that it is not too proud to do so.