At Online Marketplaces, we think that real estate portals are really interesting businesses. Here are a few reasons why...

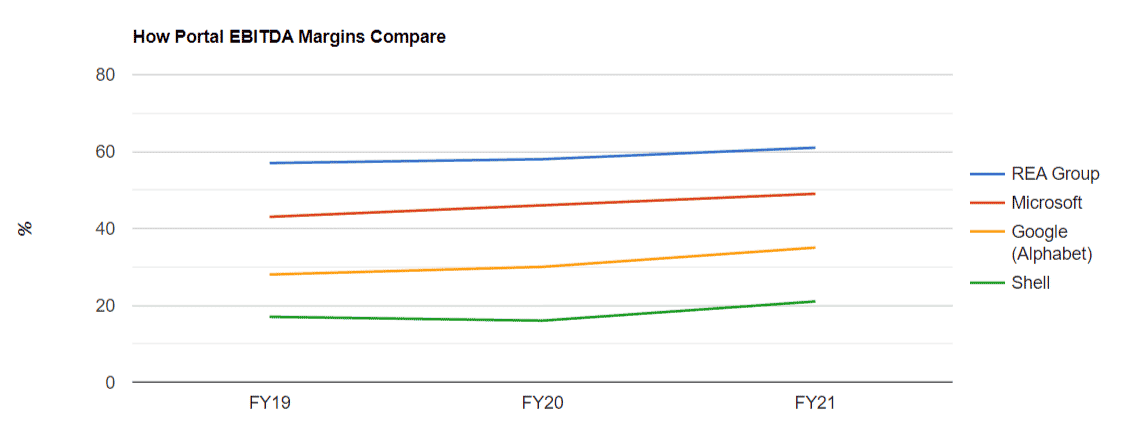

Some of the companies behind these websites are among the most profitable businesses in the world. For example, Australian real estate portal company REA Group is more profitable per dollar of revenue than some very big-name companies.

We've collected a lot of data about real estate portals and have been writing about them and talking about them at our conferences for many years. Let us answer some questions you might have about these websites we all seem to spend so much time on whether you're an industry outsider or a seasoned veteran...

Real estate portals are what we write about here but the name of the website is 'Online Marketplaces'. That's because to those in the industry, 'real estate portal' can sound a bit antiquated. Most nowadays prefer to be called 'marketplaces'.

There are actually many different names - 'property portal' (in the UK), 'ILS' (standing for internet listings service in North America) or 'online real estate marketplace' (by those in the industry) - but essentially we are talking about a website and/or mobile app accessible to the public where properties are advertised as opposed to an agent's website or general classifieds site.

There are so many different ways to sell or rent properties online and companies in the sector have all kinds of innovative business models. In general though if the property pages all have the same logo on them then it's an agent's website (these often look a lot like portals). If it has lots of different agent logos on its search results pages then it's a specialist 'vertical' portal. If it has properties but also advertises other goods or services (cars or jobs for example) then it's a generalist 'horizontal' marketplace.

How the companies that run property marketplace websites make money is a question which has become increasingly complex since the turn of the millennium when they supplanted newspapers as the #1 advertising medium for property. They did this by essentially just offering more space for advertisers.

"Classified advertising simply works better online. It is searchable and always available. There are few space restrictions, meaning multiple photographs and lots of detail." Keith Perch, former Editor of local newspapers and Lecturer in Journalism

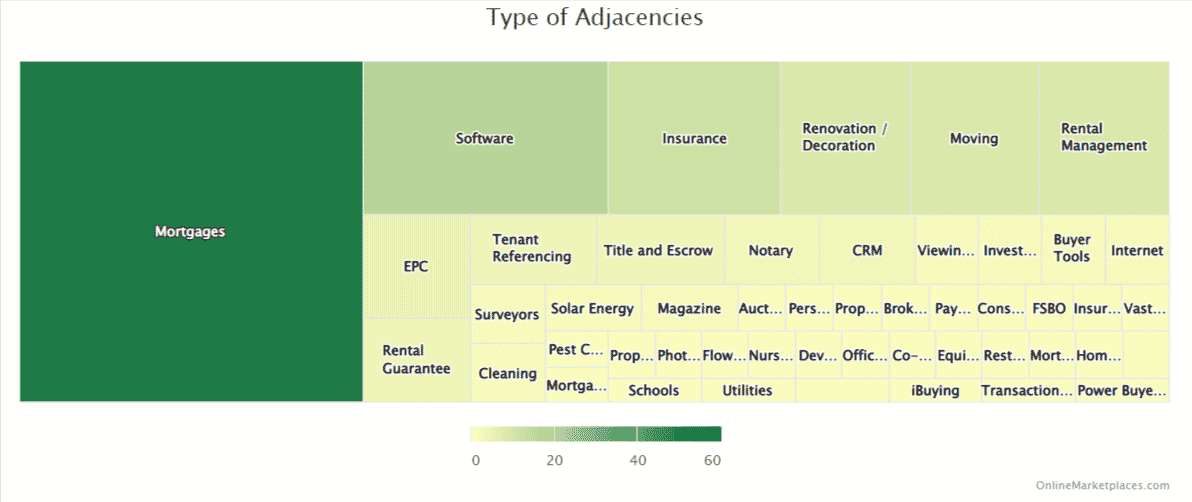

Just having a website with plenty of space, photos and detail isn't enough anymore though. Although most make the majority of their money by simply charging agents to advertise their property listings, portal companies are increasingly complex organizations with fingers in all sorts of revenue-generating pies.

We recently published a study on the adjacent revenue streams that real estate portal companies are involved in. Some big companies are making their money from as many as 12 different industries around housing transactions with the big ones being mortgage, software and insurance.

These companies that started out as basic shop windows are diversifying more and more every year but it may not be enough. Many in the industry believe that to survive and prosper, property portal companies need to not only be making money from generating leads for mortgage or insurance companies but that they should themselves become 'closer to the transaction'.

There is one great big cautionary tale of real estate portal companies trying to get closer to housing transactions. The U.S. portal company Zillow's failed venture in iBuying ran from 2017 to November 2021 and saw the Seattle tech firm use AI to generate an offer for people's houses. When homeowners accepted the bid from Zillow's 'Zestimate' tool, the company would renovate the home and sell it on.

Zillow's experiment ultimately saw the company anger its agent customers, sustain pretty serious PR damage and lose hundreds of millions of dollars. At the time of writing, it is still trying to sell off all the houses it overpaid for.

There are other (less risky) ways that real estate portals go about diversifying and getting closer to the transaction. Some, such as PropertyGuru from Singapore, spread out geographically to new markets and are looking to get into FinTech. German market leader Scout24 has taken advantage of a tight housing market and some clever acquisitions to build subscription products for landlords and home-seekers on its portal.

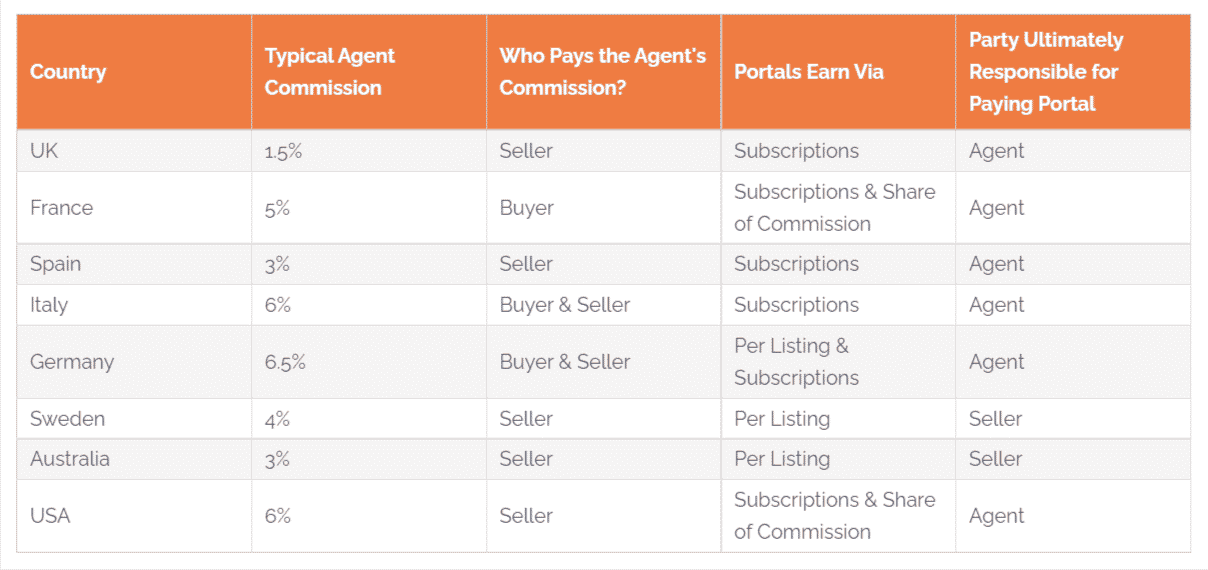

No. While we can say that in most markets, agents pay portals to advertise their client's properties for them, some operate on a per listing basis, some on subscription and some of the big players even take a slice of the agent's commission. Different real estate markets around the world work in weird and complex ways and sometimes agents aren't even the ones ultimately footing the portal bill.

In Germany and Spain for example, real estate portals allow private individuals to pay to list their properties whereas in the UK if a portal were to allow a private landlord to list their apartment for rent they would have a rebellion on their hands from their agent customers.

In Sweden and Australia, the seller is ultimately the one responsible for paying to market their property - which they do through an agent who may or may not advise them to use one portal or another. This leads some to speculate that portals in these countries can get away with charging higher prices per listing. After all, people only sell their homes maybe once a decade and they are hardly likely to keep track of the marketing price.

It depends. We interviewed several experts around the world about the relationship between real estate portal businesses and agents in their country and the best words we can come up with to sum up their answers is 'mixed at best'. The first video in the series (Australia) is below...

Portal companies around the world are constantly trotting out the PR line that they are 'agent friendly' but sometimes their actions contradict them. British market leader Rightmove was widely criticised for its initial treatment of agents at the start of the pandemic and its actions gave rise to an agent-led protest group.

In Brazil, agents accused the leading portal group Zap Imóveis of 'back-stabbing' and trying to disintermediate them back in October. Local publication DiariodoRio.com found that the portal had been contacting homeowners directly with a calculator showing them how much they could save by listing their properties directly on the portal and cutting out agents.

There are plenty more examples of agent-portal friction and attempted fence-mending out there. When they happen these stories tend to be among our most-read news articles.

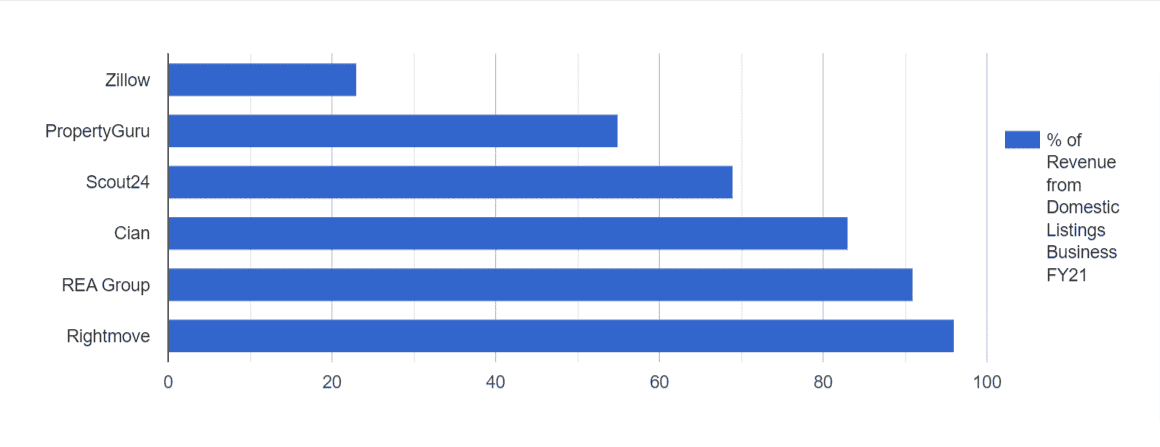

Real estate portals are strange companies. Many of them have unparalleled brand recognition domestically but are completely unknown over the border.

For example, Zillow is a household name in the United States and has entered the cultural canon by being parodied on Saturday Night Live. Despite this, the company has only a very limited presence north of the border in Canada where the market dynamics are very similar.

For example, Zillow is a household name in the United States and has entered the cultural canon by being parodied on Saturday Night Live. Despite this, the company has only a very limited presence north of the border in Canada where the market dynamics are very similar.

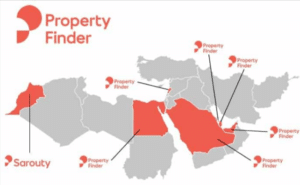

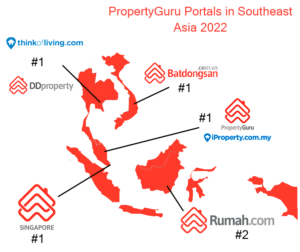

A few real estate portals have managed to make a successful transition over a national border, but it's surprisingly rare. In the Middle East, PropertyFinder has expanded from its base in the UAE to several countries in the region and in Southeast Asia, PropertyGuru has managed to do the same. There are a few other examples here and there but generally, portal companies stick to their home field.

A few real estate portals have managed to make a successful transition over a national border, but it's surprisingly rare. In the Middle East, PropertyFinder has expanded from its base in the UAE to several countries in the region and in Southeast Asia, PropertyGuru has managed to do the same. There are a few other examples here and there but generally, portal companies stick to their home field.

Consumers looking to buy property in another country are catered for by specialist portals like Juwai (for Chinese buyers looking to buy abroad), Kyero (for foreigners looking to buy in Spain) or offshoot portal domains like Rightmove overseas (for British buyers looking abroad).

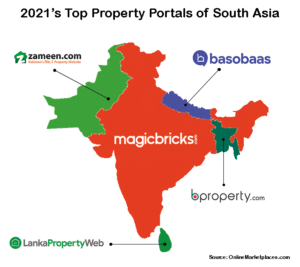

If you've ever wondered what the best specialist real estate website is in New Zealand, Chile, Russia or Morocco you're not alone. We made a series of infographics with the leading portals around the world (by traffic). Below you can see our infographic for South Asia for example.

Over the last 12 years, Online Marketplaces has been keeping a database of all the real estate marketplace sites around the world. The database currently has just under 800 entries but it's more than likely that there are over 1,000 out there and many more websites that are similar in one way or another.

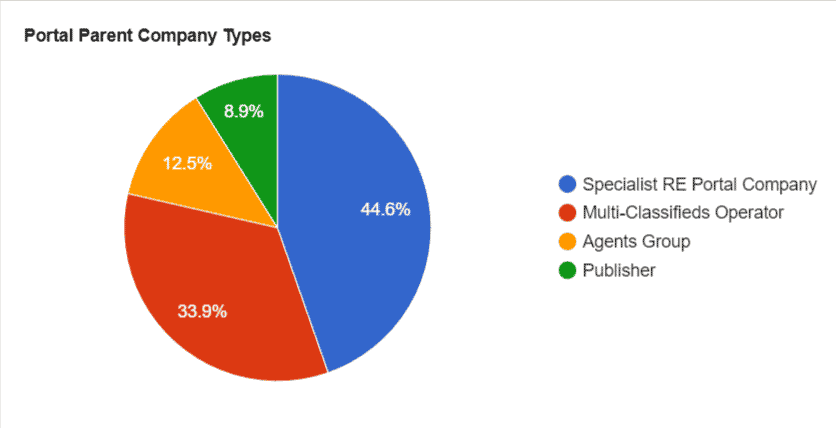

When we decided to expand our database to include the owners and stakeholders in real estate portals around the world, we were surprised by just how many of them are controlled by a handful of huge companies. Some of these include Schibsted, Adevinta, Prosus, Naspers, EMPG Axel Springer and Frontier Digital ventures.

Broadly speaking we can say that the companies that control most of the world's leading real estate portal websites fall into four categories: specialist real estate portal companies, companies that operate different types of classifieds websites, publishers and agent's groups.

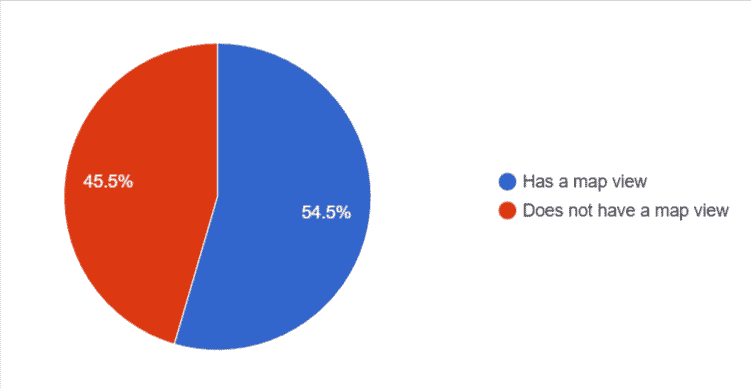

While there does seem to be a template to how real estate marketplace websites around the world look and feel, they certainly don't all have the same tools and features. Last year we published a study looking at the features of over 650 portal sites from around the world. The results surprised us. Many features we thought would be standard on portal sites around the world were not...

Virtual tours, pet-friendly filters, draw your own search and keyword-based search might have all been around for some years but these tools are taking their time to percolate through an industry that likes to think of itself as tech-driven and user friendly.

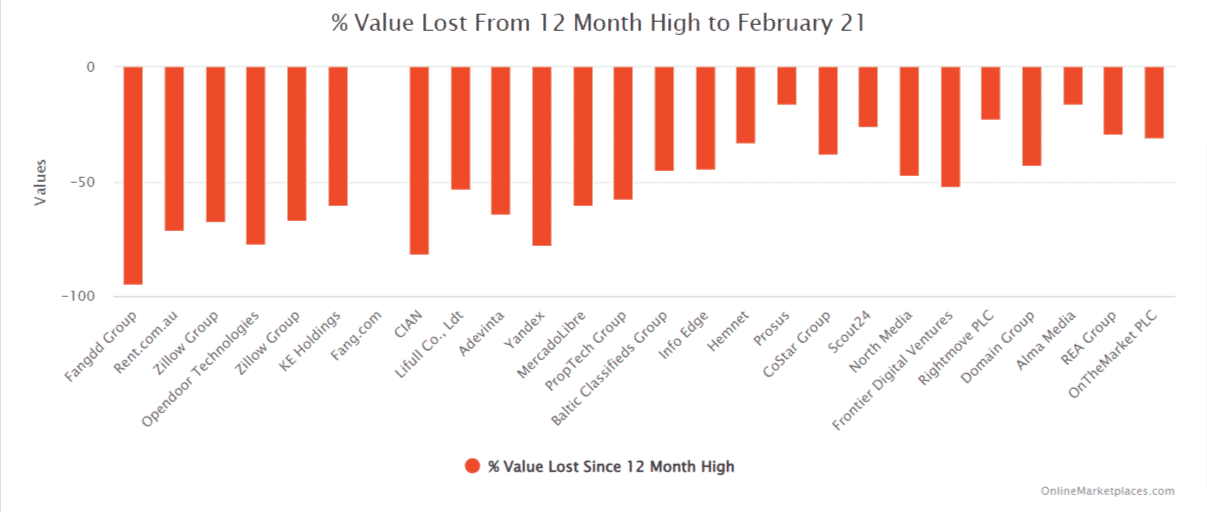

I am no financial advisor and this is definitely not intended as financial advice... There is no polite way to put this, but portal stocks around the world have been tanking recently and started losing their investors' money long before the latest selloff.

Back in February we studied the shares of 26 companies that run real estate portals and found that they had lost a quarter of a trillion dollars worth of value in the previous 12 months. Portal stocks are generally lumped in with 'tech stocks' and all 'tech stocks' seem to have been having an awful time recently.

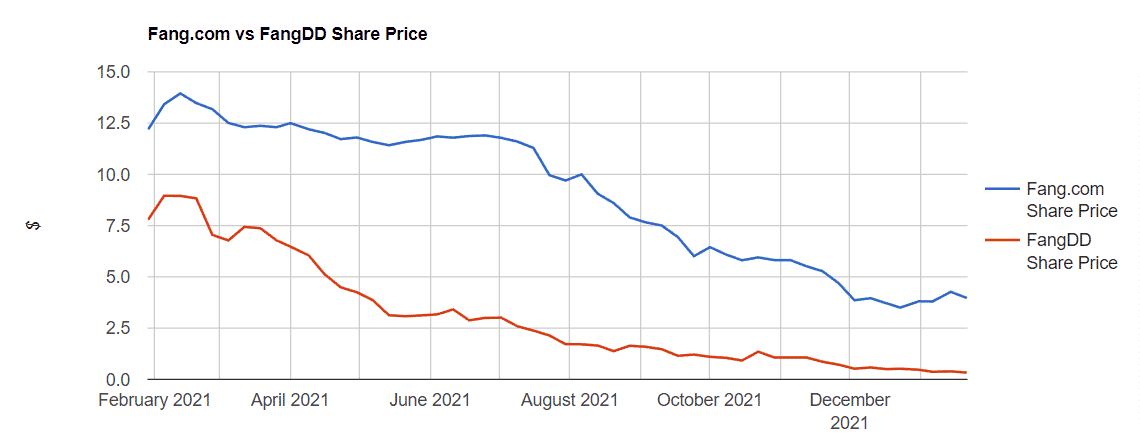

While Zillow's share price has gone from over $200 to a low of $34 in the last 15 months, Chinese portal companies Fang.com and FangDD are both in danger of being struck off the NYSE and Nasdaq for a consistently low share price and a lack of disclosure respectively.

The data used in this article comes from Online Marketplaces' database of real estate portals which includes data on nearly 800 portals, their financial and operational metrics and their features. To see some more insights based on this data, why not come to one of our industry events.