PropertyGuru is the market-leading Southeast Asian real estate portal group Founded in Singapore in 2007 by ex-pat entrepreneurs Steve Melhuish and Jani Rautiainen.

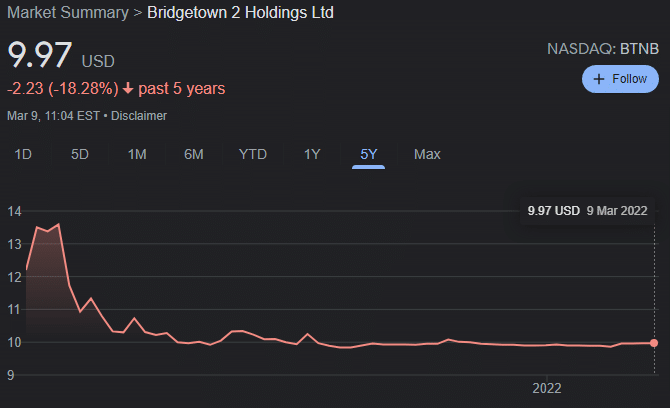

The company is set to go public on the NYSE later this month via a merger with the special purpose acquisition company (SPAC) Bridgetown 2 Holdings after flirting with a public offering for nearly a decade. As PropertyGuru prepares to make its belated debut, we bring you a visual guide of the company's business and how it compares to its peers overseas...

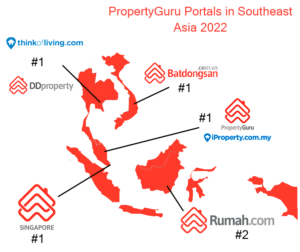

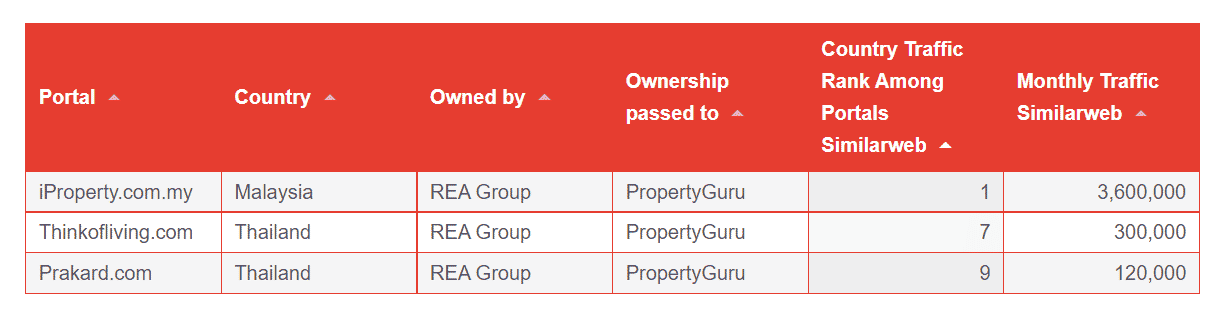

PropertyGuru has been a market leader in its native Singapore almost since its foundation. It acquired the leading Thai portal DDproperty in 2011 and the leading Vietnamese real estate vertical Batdongsan.com in 2016. After its landmark deal with REA Group last year, the company also effectively sealed up market leadership in Malaysia where it now controls iProperty.

The only country the group operates in where it is not a dominant market leader is perhaps also the one with the most potential. With 270 million potential users, Indonesia has more than double the population of any other market the company operates in.

In 2013, PropertyGuru co-founder Steve Melhuish admitted to TechInAsia that the company's first foray into the country wasn't done right.

"almost overnight we added Malaysia, Indonesia, and Thailand. And so, the teams got so stretched. In hindsight, it was a bit of a mistake, putting the teams under so much pressure and close to breaking point."

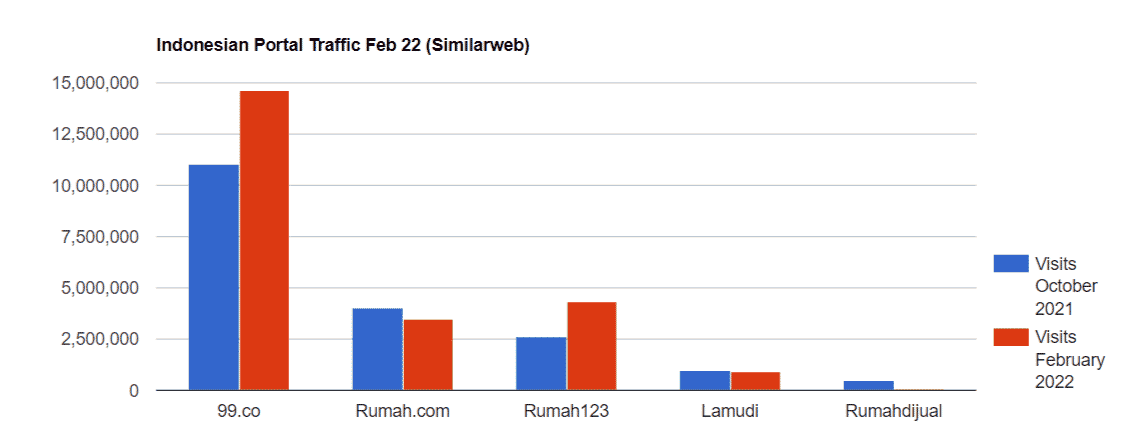

In addition to Rumah.com (bought in 2011) PropertyGuru bought out RumahDijual in 2015 and has built its traffic and market share in Indonesia since then. Despite gains since then though, it is still in second place in terms of traffic.

N.B. 99.co traffic calculated as the percentage of domain-wide traffic from Indonesia (70.1% in February 2022).

Although the company's prospectus recognises that the TAM in Indonesia's property market ($400m) isn't as large as Singapore ($460m), Vietnam ($520m) or Thailand ($580m), it has the potential to be bigger than all of them in the long run.

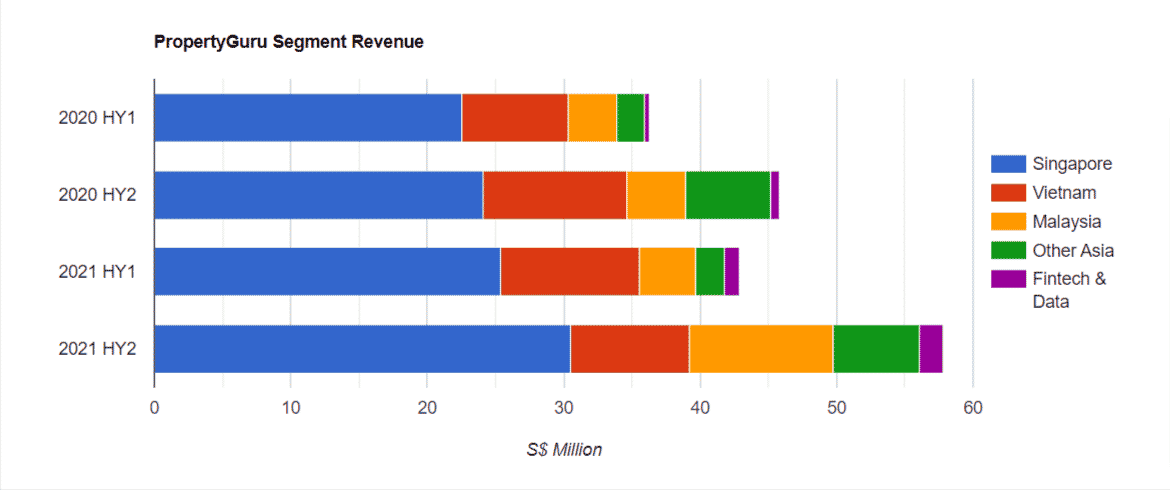

In addition to generating revenue from real estate listings via agents and developers, PropertyGuru, like many modern portal companies, has been telling the world that it is undergoing a transition towards being a FinTech operator.

The company's prospectus makes clear that its valuation is based on a growth rate far above some of its big-name international peers. It also makes clear that the segment which the company expects to grow fastest in is its nascent 'Data & FinTech' offering.

Souce: PropertyGuru Prospectus

At the moment PropertyGuru's FinTech offering consists of its mortgage lead generation and brokerage business which, as some analysts have pointed out, faces stiff competition from established financial players.

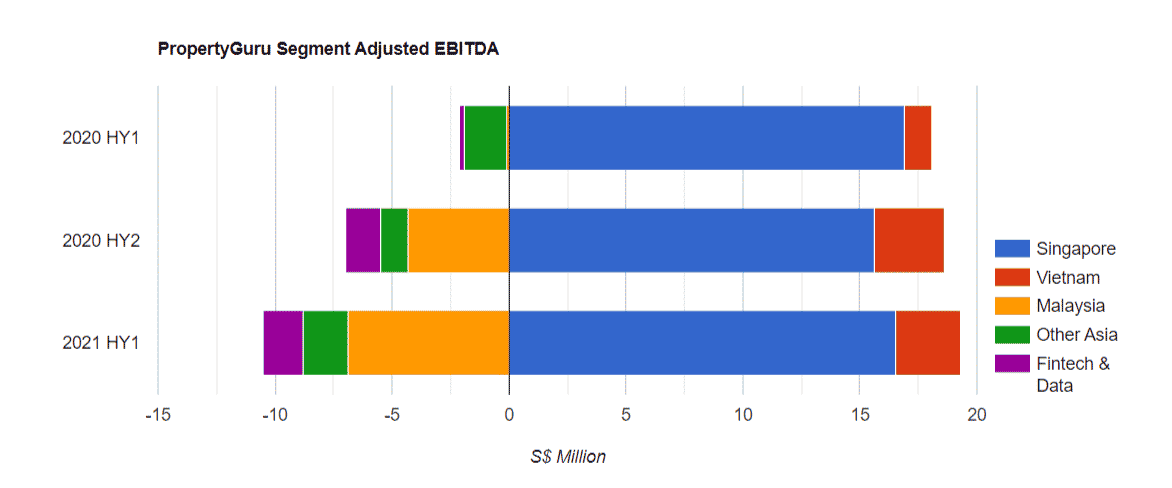

Its data intelligence business is more diversified but at the moment, both the data and FinTech offerings are firmly in their investment and growth phases and both are still heavily reliant on the more sophisticated (and smaller) Sinagpore market.

Obviously, many real estate portals see huge potential in financial and data products and there's no reason why PropertyGuru can't scale this segment as a market leader. It may well need to throw a lot more money at the problem though, which is where the next point comes in...

Following the deal for REA Group's Southeast Asian assets last year, PropertyGuru now has all the portal websites it needs for the markets it operates in.

Taken from PropertyGuru's July 2021 Prospectus

The company stands to net around $440 million from the upcoming float and PropertyGuru's CEO Hari V. Krishnan has said that "M&A is very much on the agenda".

Likely first on the shopping list will be a financial player to consolidate the company's FinTech offering and build bridges into new revenue streams.

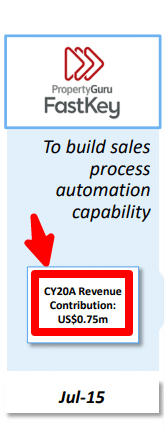

With the increased scrutiny that comes from publishing specific financial details on its balance sheet though, PropertyGuru will have to use these funds wisely. The company has already been criticised in some quarters for the perceived poor performance of its developer sales platform FastKey (formerly ePropertyTrack) which having been acquired in 2015 has perhaps not had the expected impact on the bottom line.

At its core, the value proposition for many potential PropertyGuru shareholders is that they will be investing in a business with a model which is known to generate 70+% EBITDA margins in some mature markets.

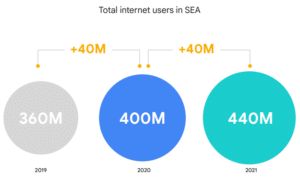

The theory goes that although most of PropertyGuru's markets are not truly mature, sophisticated real estate markets yet, the trends of urbanization and internet penetration in Southeast Asia mean that they will be fairly soon.

The influential 'e-Conomy' report from Google, Temasek and Bain & Company recently dubbed 2021 and the subsequent decade the "Roaring 20s: The SEA Digital Decade" based on some pretty extraordinary statistics.

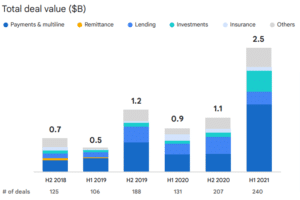

Aside from the huge numbers of people becoming internet users each year in the region, two relevant trends highlighted by the report were the adoption of digital financial services (particularly lending) and the value of deals in the financial services category which exploded in the region in the first half of 2021.

There is a lot of overseas investor interest in the region at the moment and with very good reason. PropertyGuru is certainly well placed to capitalise on it.

Singapore is easily PropertyGuru's top market and the percentage of its revenue the company generates on home soil has only gone up in recent times.

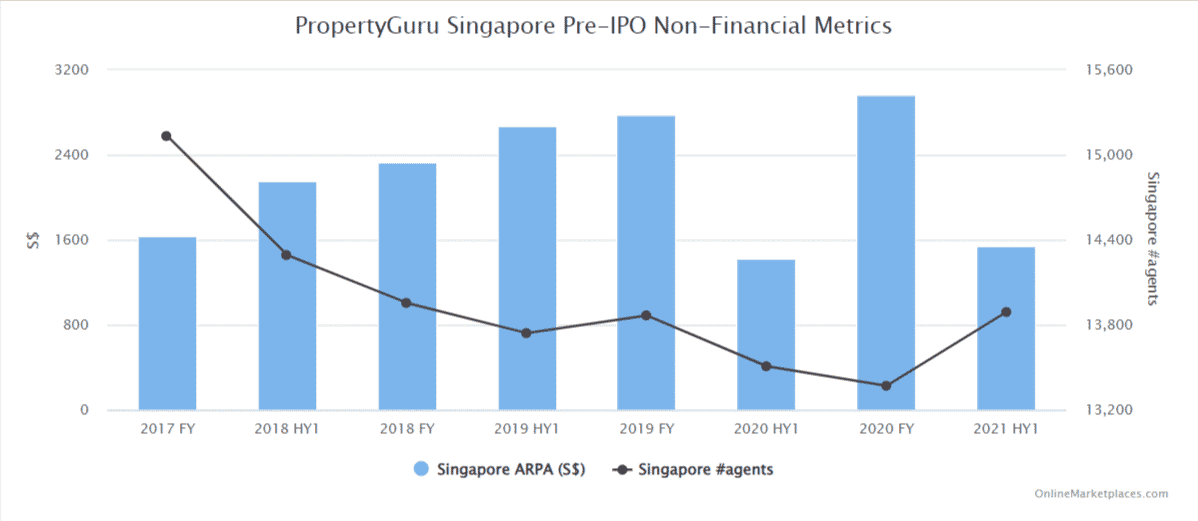

It's a mature market and one whose inhabitants are uniquely obsessed with property. PropertyGuru is forecasting a 16.2% CAGR in Singapore and was similarly sanguine on its chances when compiling its prospectus for its aborted IPO attempt in 2019.

There are several issues that the company will have to overcome in its native market to make the projected growth a reality, not least of which is the fact that the vast majority of agents in the city-state are already PropertyGuru customers.

To be fair, the company's 2021 prospectus does not expect agent numbers to rise from the 14,000 or so that it currently counts as customers. Instead, it expects the growth to come from the mythic Average Revenue Per Agent (ARPA) metric.

The 2019 prospectus sums up this tried and tested real estate portal strategy perfectly, and the tactic hasn't changed for 2022 either:

"We focus on renewals among high-value, loyal subscribers and upselling Agents to move up to higher tier subscription packages. Furthermore, given the relatively mature nature of the Singapore market, we believe that Agents need to differentiate their listings. We seek to capitalise on this need by introducing a wider range of Depth Products to allow Agents to increase the prominence of their listings."

Others, notably Rightmove in The UK, have played this game to perfection over the years - leveraging a very strong market-leadership position to sell agents ever more intricate and pricy services that they can't wean themselves off.

There are two potential issues here, potential anti-monopoly regulation (in this case something of an unknown as there hasn't been any noise from Singaporean authorities) and agent rebellion (for which there is a precedent).

In both 2017 and 2019 agents in Singapore expressed their collective displeasure with PropertyGuru's price rises. Like similar agent complaints in the UK though, there wasn't enough collective action to force any kind of retreat from the portal though.

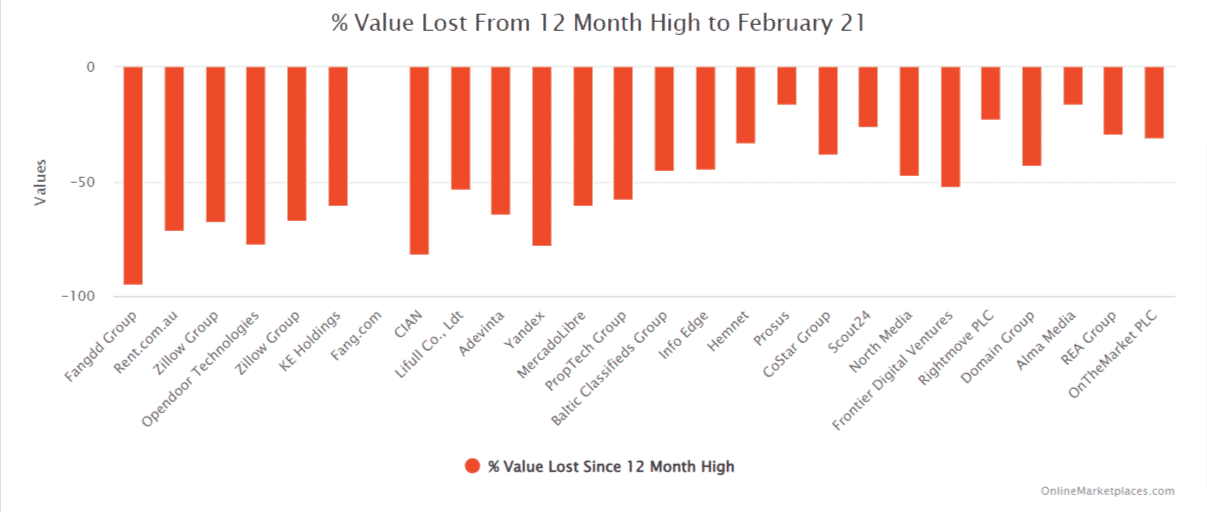

March 2022 may go down in history as one of the absolute worst times to become a publicly-traded tech company. At the start of February, an OnlineMarketplaces.com analysis revealed that between them, publicly traded companies that operate real estate portals around the world had lost over a quarter of a trillion dollars. Since we published that piece, the figure has risen even further to around $0.35 trillion at the time of writing.

PropertyGuru has some sophisticated investors on board with the likes of REA Group, Thiel Capital and Baille Gifford as well as previous investors KKR and TPG but with current market conditions being what they are, retail investors may not be jumping at the chance to own a tech company operating halfway around the world.

Shares in the SPAC which is set to take PropertyGuru public later this month have been trading at a pretty steady $10 since May 2021. Stability like that will be a thing of the past once the merger happens and investors will have to get used to it.

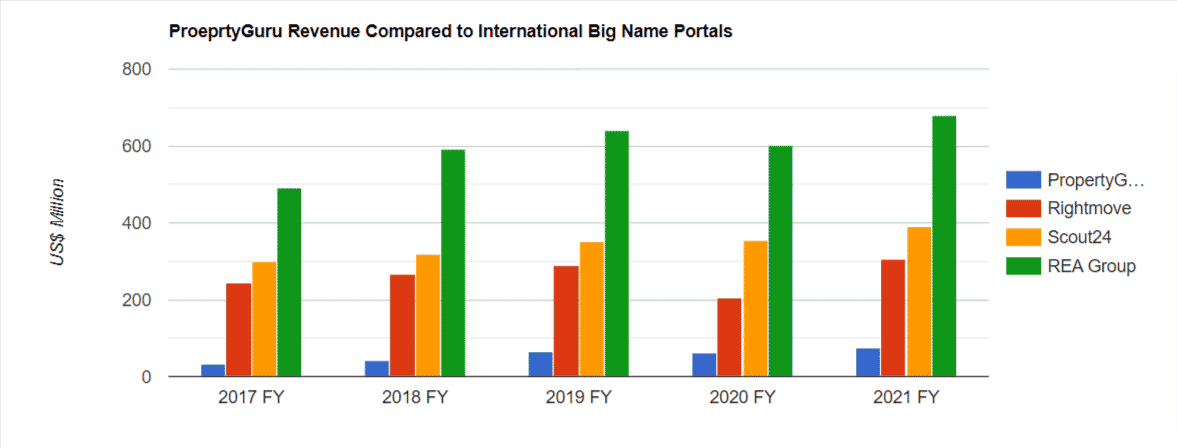

The company is well known in its industry and among consumers in its markets but the PropertyGuru name does not yet ring out like Zillow, Rightmove, Scout24 or REA Group.

Those companies have made a name for themselves outside the industry largely because of their exceptional financial performance (Zillow notwithstanding). Market dominance and EBITDA margins like Rightmove are the goal of all portal companies and although PropertyGuru has similar levels of brand awareness in its native market, its financials are not nearly on a par with the big boys yet.

The company has not been forthcoming when it comes to profits in its last two missives to the market, but from an Adjusted EBITDA prediction in the 2022 prospectus we can make an educated guess that the company's adjusted margins were around -17% for 2021 - although given how every company likes to use different metrics, an apples to apples comparison is difficult.

That said, Adjusted EBITDA margins for the company's Singapore business are regularly hitting the heights achieved by the big boys and have been between 65% and 75% for the last few years according to company filings.

Investors will be hoping that once this month's IPO is out of the way, PropertyGuru will be able to reach these heights and become the darling of investors that Rightmove has long been. It will certainly be interesting to follow the company's journey as a publicly-traded portal...