Indian real estate marketplace business Square Yards has today released its figures for the first quarter of the Indian financial calendar. Highlights of the company's latest set of figures include:

Square Yards operates a number of diverse business segments both in India and abroad. Apart from operating a domestic end-to-end real estate solution that includes portal, mortgage and property management businesses, the company also operates in markets with a strong Indian diaspora such as Canada, Australia and The UAE.

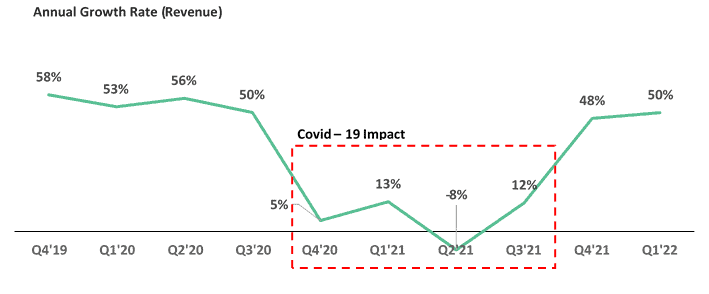

Although its domestic market was in lockdown for the entire quarter amid concerns about the Delta variant of Covid-19, the Gurgaon based company managed to record impressive growth figures for its Global Real Estate segment which drove revenue growth back towards pre-pandemic levels.

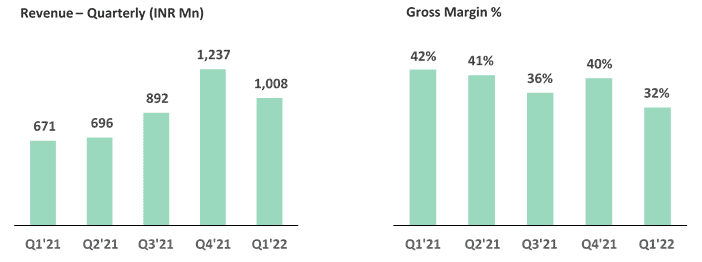

In terms of profit, the firm's gross margins dropped slightly on both a yearly and quarterly basis to 32% over the quarter. Guidance for the financial year remains the same as that expressed in the company's yearly report in May with the last 3 months having contributed 16% of the $85-90 million in revenue predicted for the year in line with historical trends for the summer quarter.

The latest three months have seen Square Yards secure $25 million in "venture debt" from Hong Kong-based ADM Capital to go after an "accelerated growth curb" that the company finds itself on the cusp of according to the company CEO and Founder Tanuj Shori.

The firm also recently added another revenue stream to its armoury and further rounded out its offering for consumers by setting up a new interior decoration company which, according to today's press release, contributed to the $1.5 million in revenue generated by the firm's New Business segment which includes several SaaS services and property management.