Rightmove is not only the market-leading property portal in the UK, it's also the example that just about everybody in the global portal industry uses to describe what market leadership looks like.

The Milton Keynes-based firm operates at an EBITDA margin of around 70%, improves its unit economics every year, has all the country's agents' listings on its site and has made a lot of money for its shareholders.

It has done all of this for more than 20 years without turning to any of the adjacent revenue streams or transactional bells and whistles that most other portal companies have tried.

While British consumers see Rightmove as a trusted place to look for a home, agents mostly see it as an uncaring, monolithic corporation. The company has rarely shared much about its plans perhaps because they have typically read "business as usual"—no need to say or do anything that might rock the boat as long as agents keep paying.

Until now...

The U.S. real estate giant CoStar is worth $34 billion and has a track record of success when it comes to building up challenger portals. It's also about to buy one of Rightmove's main competitors with the expressed intention of taking its crown.

In that context, the Capital Markets Day Rightmove held this week was a rare and fascinating insight into what the company intends to do about all of this. So what did Rightmove leadership say about plans for the next five years?

Although he did ask why moving house couldn't take 20 days instead of six months and there was some abstract talk about a "moving journey assistant", Rightmove's recently appointed Chief Executive Johan Svanstrom largely kept it simple when outlining the opportunity the company sees between now and the end of 2028.

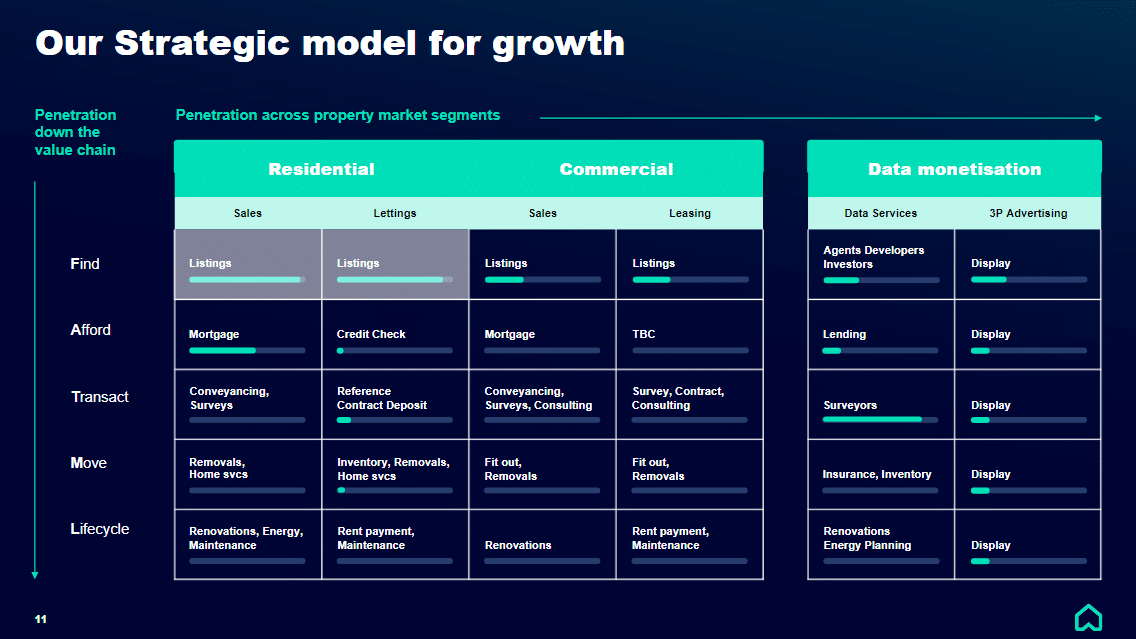

In a slide that resembled its counterpart from German market leader Scout24's Capital Markets Day two years ago, Rightmove's boss showed that the company thinks about its business in terms of a "home lifecycle" with three monetization streams on the X-axis.

Above: How Rightmove thinks about its business and the opportunities around it. Source: Rightmove CMD presentation November, 2023

It was perhaps not a surprise to hear that Rightmove's focus will continue to be on its core around the 'find' phase but the company does plan to make its most significant efforts to date to diversify the business, particularly into residential mortgages, commercial real estate and end-to-end software tools for lettings agents.

Some of the key monetary metrics being targeted by 2028 are £600 million in revenue, £420 million in post-tax profit and annual double-digit profit growth.

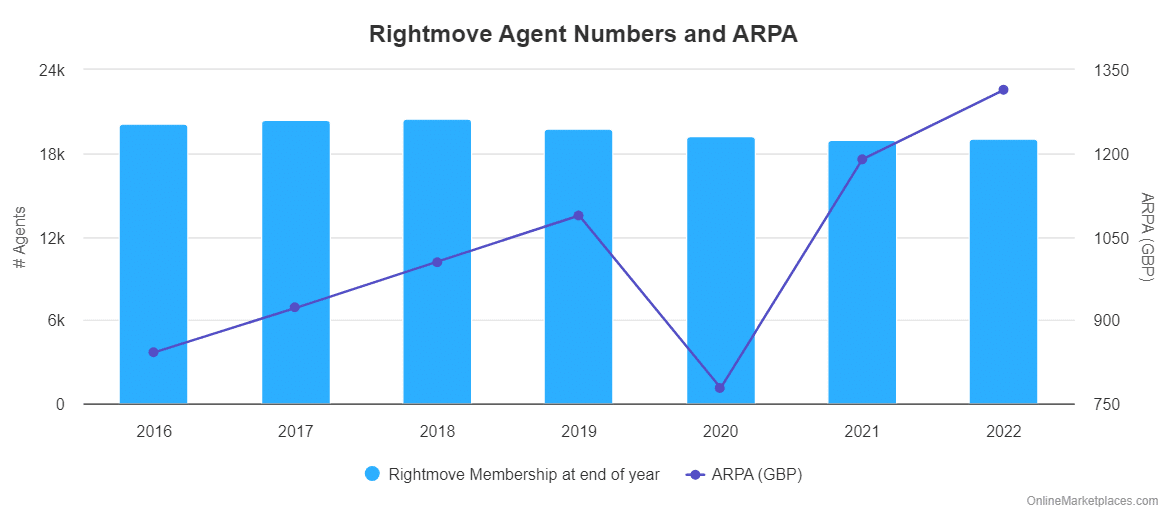

As for the all-important Average Revenue Per Agent (ARPA) metric that agents and shareholders have their eye on for different reasons, the expectation is that growth will accelerate with agencies paying an extra £135+ extra every year by 2028 (the guidance for 2023's ARPA growth was reiterated as £112-£116).

Rightmove's CFO, Alison Dolan stressed that the growth would be "product-led" with agents paying more for extra products and services rather than being led by price increases which she said would continue to be "steady and compounding". Dolan also stated that Rightmove is not factoring in any significant fluctuation in agent numbers into its planning.

One of the headlines from the presentation was that Rightmove is following many of its international peers into the mortgage market. However, MD of Financial Services Dave Cray was quick to point out that the company would be doing this differently from the likes of Australia's REA Group which has bought up an established mortgage brokerage business.

Rightmove will be sticking to lead generation. Even so, the company values the total addressable market (TAM) it can attack at around £250 million and is excited by the opportunities in a fragmented UK mortgage brokerage landscape.

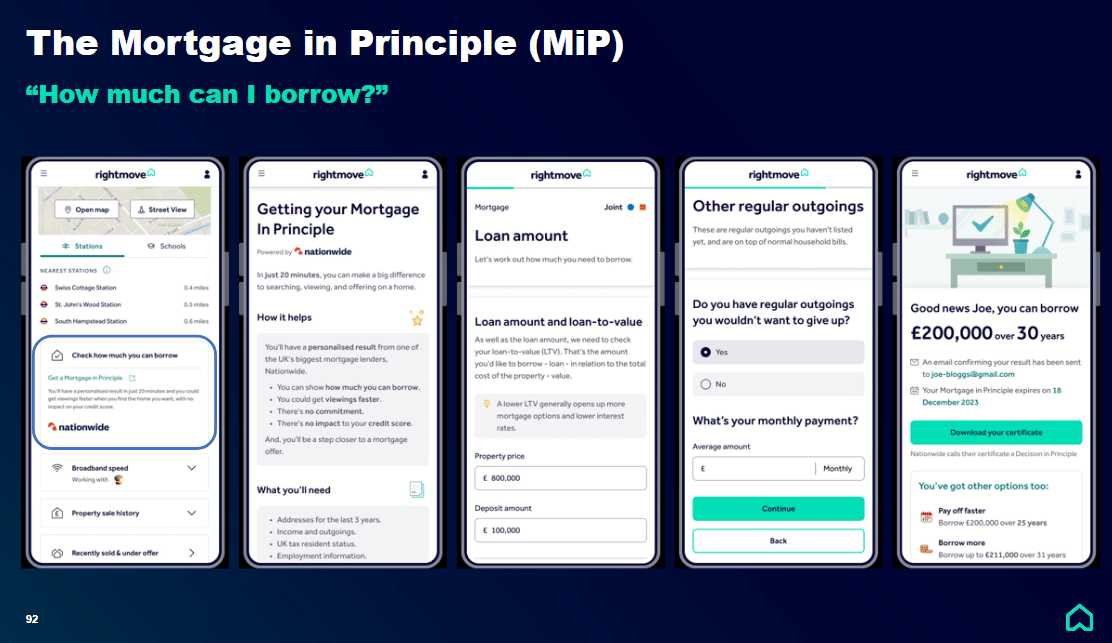

Above: Rightmove's Mortgage in Principle product. Source: Rightmove CMD presentation November, 2023

For now, the flagship product of Rightmove's financial services division is its 'straight to lender' Mortgage in Principle (MiP) built in partnership with one of the country's largest lenders, Nationwide.

Users looking for an indication of which listings they can afford can fill in forms hosted on the Rightmove site or app and potentially be given a binding mortgage in principle from Nationwide in as little as 20 minutes.

Cray told investors that Rightmove's partnership has already generated around 50,000 MiPs with logged-in users that have generated an approved MiP representing leads that are 45 times richer in data than regular leads.

There is also a remortgage lead product which Rightmove is planning to use in conjunction with another new tool.

Following the example of other portal companies such as REA Group and its historical rival Zoopla, Rightmove has launched a tool that lets users track the value of their homes. There are high hopes for the tool with Rightmove COO, Tarah Louens saying the company expects 6.5 million homes to be tracked over time.

More controversially, the company is also in the early stage of testing a mortgage brokerage product to capture revenue from the estimated 85% of UK residential buyers that seek intermediation instead of going straight to a lender.

Most agencies in the British market make a sizeable chunk of their income by using their own in-house mortgage brokerage businesses or recommending third-party services. Rightmove's insistence that it only decided to go ahead with a brokerage product after extensive consultation with agent customers is already falling on deaf ears with one agent (above) taking to LinkedIn to vent about the portal's plans.

For the time being the product is only being tested on users who are denied a mortgage in principle but there are plans to broaden the top of the funnel for the brokerage product and ramp up monetisation over time.

Agent outrage has rarely swayed Rightmove's position over the years and the £25 million the company plans to generate from its financial services division by 2028 will no doubt provide extra resolve.

According to Rightmove's MD of Commerical Real Estate Andrew Miles, the portal already accounts for 70% of portal visits in the sector but still sees room for significant growth.

Rightmove plans to invest £3 million in its commercial operations through 2024 with incremental investment following after that.

Asked why the company suddenly sees an opportunity in the sector, Miles, who was a founder of Rightmove competitor Realla which was bought out by CoStar in 2018, answered candidly:

"Previous leadership at Rightmove was less interested in commercial and just saw it as something to be milked opportunistically for some revenue."

The portal company has plans to penetrate deeper into the market as well as long-term plans to provide an end-to-end software service for commercial agencies along similar lines to its 'Lead-to-Keys' offering in the rental sector.

For all the talk of diversifying, Rightmove will continue to be driven by what it does best and Chief Revenue Officer David Anderson shared some interesting stats that show just how strong the portal's core subscription business is.

Rightmove's average customer tenure is 15 years, the average number of listings is 881,000 and the portal has seen a 350% increase in the volume of leads per listing since 2019.

The strength of Rightmove's brand was a common theme throughout the CMD presentations and that brand strength is key to the firm's future plans in its core business area serving sales and lettings agencies.

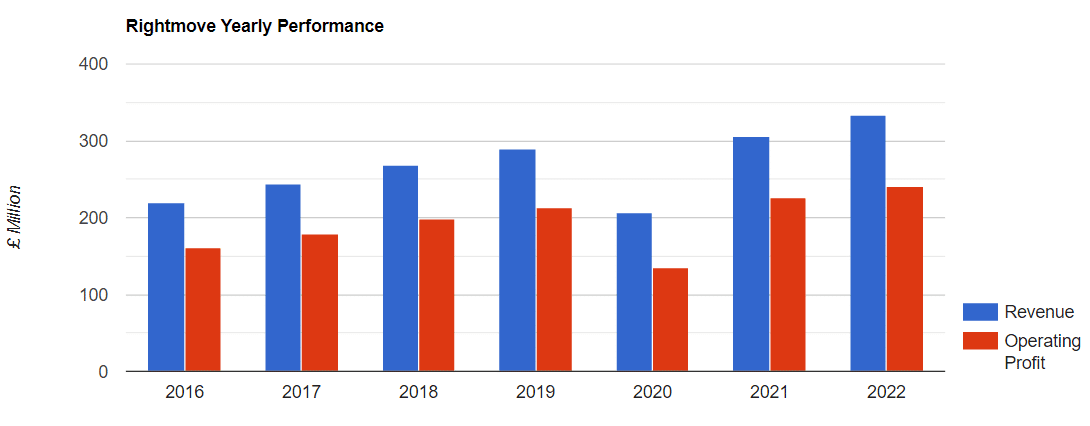

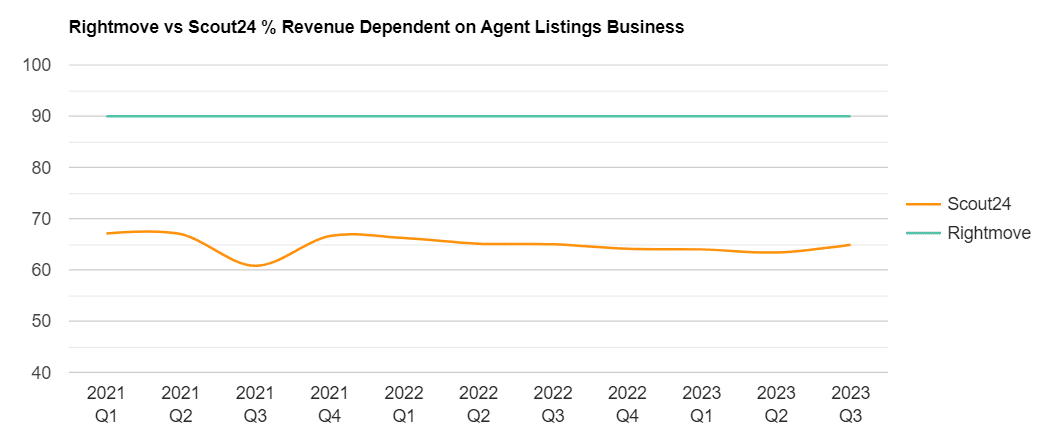

Above: Although many of its international peers have diversified, around 90% of Rightmove's revenue has historically come from its exceptionally strong core subscription listings service.

Rightmove calculates that the sales and lettings commission pool in the UK was £3.8 billion in 2022 and that agencies spent around 15% of that (£570 million) on marketing and portal expenses.

The headline that agents won't want to read is that Rightmove believes that "there is still plenty of headroom left for us to compete for". That is to say, the portal believes agents can and will spend more than 15% of their revenue on marketing and portal subscriptions.

"There are historic precedents for agents spending more than 15% on marketing. And some of our customers are already spending more than 15%."

The company will continue to go after that greater percentage of agents' marketing spend in the same way it has done recently—by slowly moving them onto progressively more expensive subscription packages and relying on its branding power to bring the traffic to keep them there.

Similarly to many real estate portals around the world, Rightmove charges agents on the cheaper packages more for the basic listings service with premium packages costing more overall but with lower listing fees and access to many more of the portal's marketing and branding tools.

Anderson revealed that a full cycle to move all customers on from the most basic package takes between five and seven years.

In the rentals sector, Rightmove will continue to lean on its 'Lead-to-Keys' product which provides agencies with an end-to-end software solution for tenancies. The portal claims that the efficiency gains agencies derive from the product are worth more than the cost of their subscriptions.

Rightmove may argue that the Capital Markets Day had been in the diary for some time. But its timing, coming a few weeks after Rightmove shareholders were advised by Citigroup to sell following CoStar's bid for OnTheMarket, certainly seems pertinent.

Although several slides showed select Rightmove metrics as they compare to the portal's "newest competitor", the CMD presentations did not mention OnTheMarket and its presumptive new owner CoStar by name.

There was a slide dedicated to showing all the threats that Rightmove has seen off over the years and a thinly veiled implication from Svanstrom that traffic can be bought but user intent and brand equity cannot.

Predictably many of the questions from shareholders and analysts in the Q&A session were about Rightmove's challenger. Largely they were handled with a straight bat and insistence that Rightmove does not comment on competitors' specific plans. There was however one terse reaction from the Rightmove Chief Executive when an analyst suggested that Rightmove was not really doing much to respond to CoStar's entrance into the market:

"We don't rest on our laurels. We realise that the dynamic has changed."

Although perhaps conservative compared to its international peers, Rightmove's plans to finally diversify its business suggest that it is indeed not waiting for the guillotine to fall.