The subscription model for real estate portal businesses is flawed.

At least that's according to European Internet Ventures founder Malcolm Myers who told attendees of Property Portal Watch Madrid that when portals don't use performance-based monetization models "there's something intrinsically working against the perfect function of the market".

The theory goes that as technology better enables marketplace businesses to match home hunters to properties rather than have them search through listings, the fewer 'premium' visibility slots you can sell to agents.

Given that earlier this year we found that 39% of real estate portals around the world seem to be using some form of subscription-based model as their primary source of revenue, there may well be many portal board rooms discussing whether to change tack or not.

Perhaps the best case study out there for any real estate portal executive thinking about whether to switch gears and change their business from a shop window to something else is that of two dominant European market leaders, Scout24 in Germany and Rightmove in the UK.

As public entities, the two real estate portal companies share a lot of metrics with the market and have a lot more in common with one another:

Apart from the homeownership rates in their markets (Germany's is around 50% while in the UK the figure is around 63%), the big difference between the two is that one has taken the plunge and made significant efforts to diversify its revenues and the other has not.

The British market leader is famous for being the place that the nation turns to when looking for a new home. It's also infamous among its agent customers for its annual price rises.

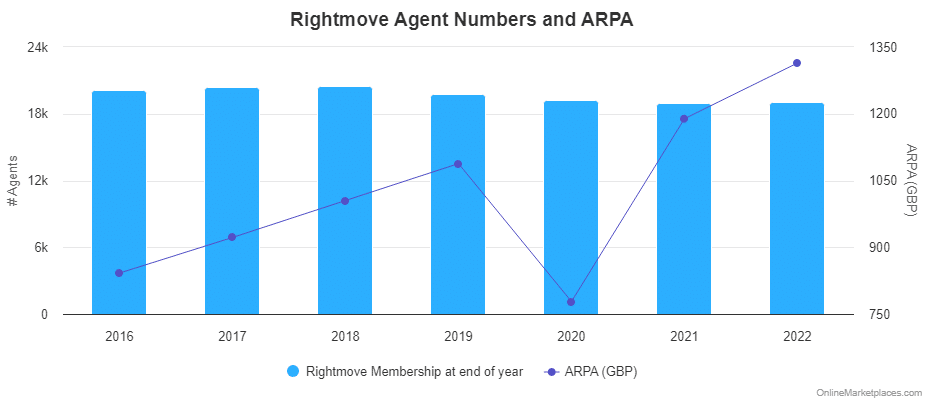

On average Rightmove made £1,314 every month from all of its 19,014 agency branches in 2022. That figure will no doubt rise again when the company reports its 2023 numbers with company Director Miles Shipside recently defending its latest price hike by turning to a tried and trusted line:

"...it's not about the cost, it's about the value of the product."

Rightmove uses its extraordinary network effects and branding to justify its price rises and knows that as long as consumers use its portal, agents will have to pay to list.

In terms of its model, the company is very conservative and doesn't tend to get involved in adjacent revenue streams such as mortgage and insurance. The only significant M&A activity at Rightmove over the last few years was the 2019 agreement to purchase tenant referencing services and rent guarantee insurance provider, Van Mildert.

It would be fair to say that Rightmove's move into the realm of facilitating rentals has been a dip rather than a plunge. There have been a few product releases but nothing major and in 2022 the Van Mildert business (renamed Rightmove Landlord & Tenant Services) failed to perform well enough to trigger the £2.4 million extra consideration on top of the original purchase price.

The Munich-based company had a road to Damascus moment in 2021 taking advantage of a capital markets day to tell investors that it was going to serve both professionals and private individuals whether they were looking to buy, rent or manage property. A big leap for a portal company that was forged as a marketing business.

Perhaps the most important part of Scout24's paradigm shift was to start monetizing the end user. Ordinary people looking for a new home in Germany could now sign up for what was effectively a premium service.

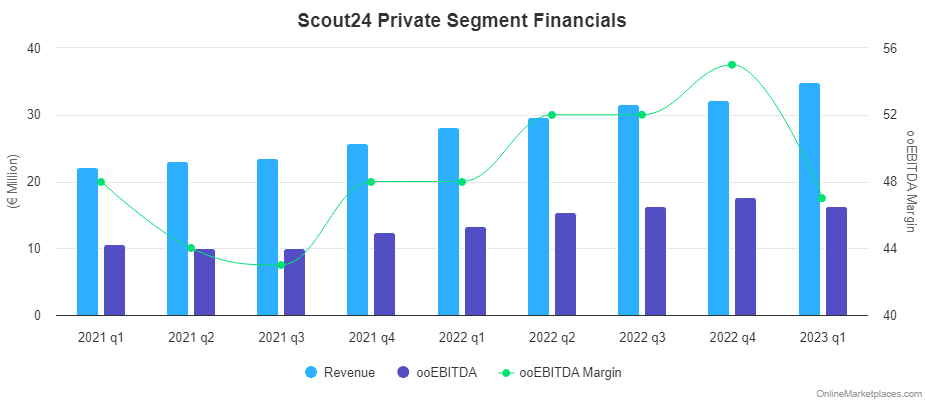

The company's 'Private' segment is composed of three premium services: one for landlords, one for sellers and, the most popular one, for renters.

The products bundle some services that Scout24 can offer as the operator of a powerful marketplace (message some landlords earlier than non-premium users) with some from third-party partners (discounts on storage and moving boxes) and are priced as convenience product subscriptions.

The products have been massively successful and are generating over €30 million per quarter in revenue at profit margins of around 50% with the company's latest figures showing almost 350,000 people subscribed across Germany.

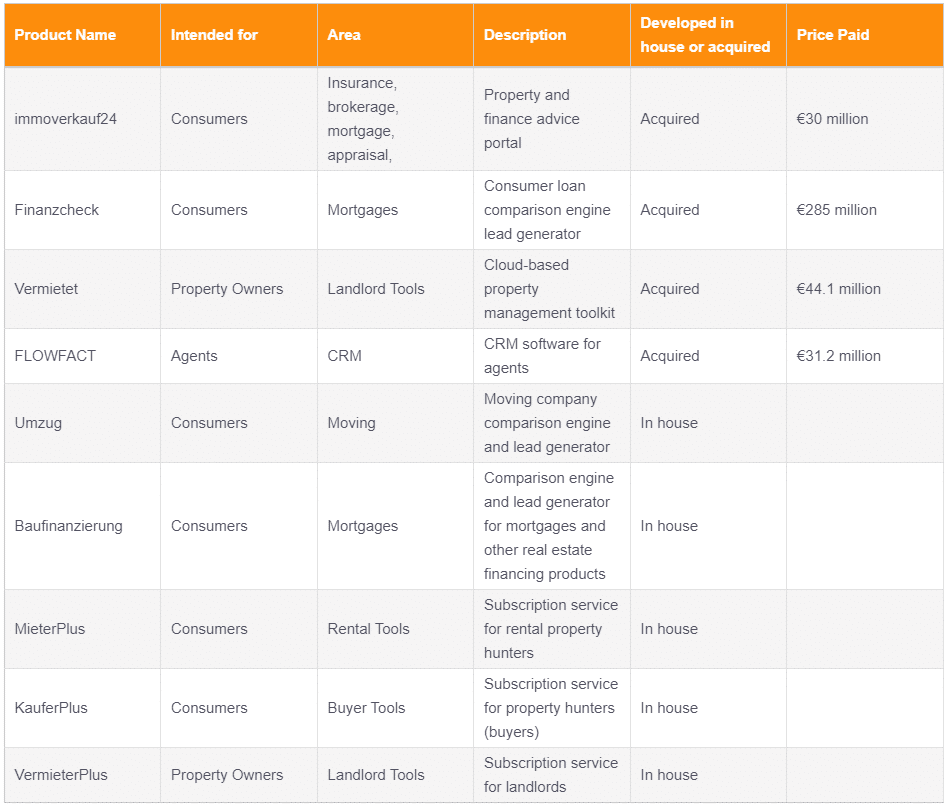

Shifting the way that the company does business and who it targets as customers wasn't an overnight metamorphosis. Over the past few years, Scout24 has paid hundreds of millions of Euros in acquisition costs and put in thousands of development hours to round out its suite of products.

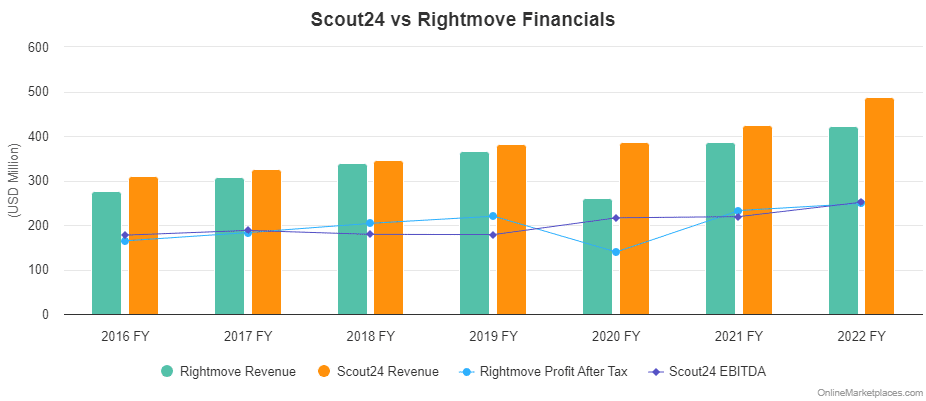

In terms of the financials of the two businesses, both have enviable and similar profit figures but Scout24 has started to pull ahead of its British counterpart in terms of revenue in recent years.

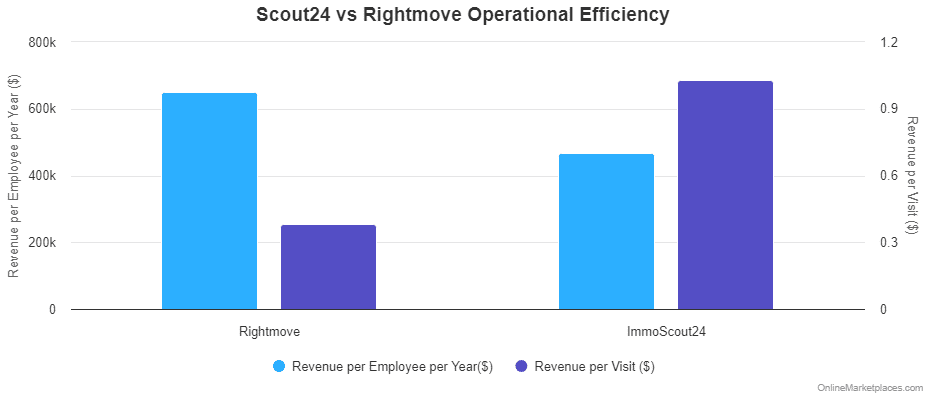

According to Similarweb* Rightmove pulls more than double the visits to its website but in typical German fashion, Scout24 appears to be far more efficient at monetising those visits.

On the other hand, Rightmove is more efficient on a per-employee basis. For each of the 647 employees reported in its 2022 financial report, it generated $650k of revenue compared to $467k per employee for Scout24.

* We took the Similarweb traffic figures from April 2023 and multiplied them by 12 months of the year for the figure used.

They say it's easier to upsell than to acquire new customers. That's only true to the point that the existing customers have enough money to keep buying the upsell.

Rightmove's ability to extract ever more from its disgruntled customer base is remarkable but, surely, limited.

The company has been a darling of investors for many years but at some point, it will have to start either offering agents more like its US counterpart Zillow, which is increasingly looking like a brokerage, or it will have to diversify into adjacent revenue streams.

This isn't necessarily because if it doesn't it will fall behind competitors like Zoopla and OnTheMarket. That remains incredibly unlikely to happen any time soon. It's more about investors realising that other market-leading portal businesses around the world that aren't standing still are having success.

Scout24 has managed to maintain growth in its core business and added a new, complimentary string to its bow. Whichever way you slice it, the hard work and the paradigm change appear to have paid off.

The fact that by taking the plunge and diversifying Scout24 now has monetary relationships with around 350,000 people that it wouldn't have otherwise is massive. Germany is perhaps now the only place in the world where people looking for a home are happy to pay a marketplace a recurring fee for enhanced services and now that consumer behaviour has taken root they may well be willing to pay for other things Scout24 wants to market to them.

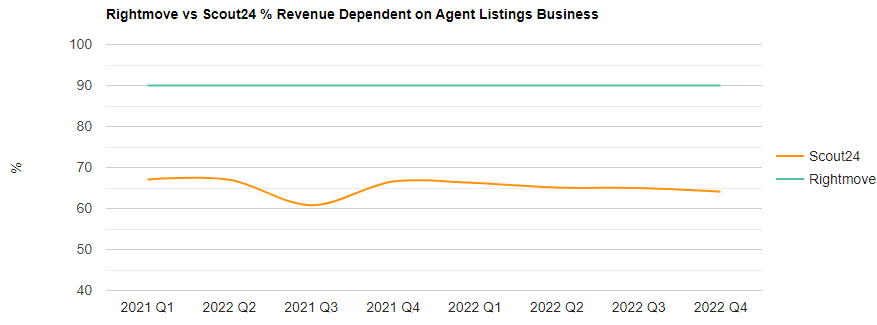

The other important consideration here is the COVID-19-related dip in 2020 that Rightmove saw. 90% of Rightmove's revenue comes from agents and if agents can't or don't want to pay then that's a big issue. Scout's diversification of its customer base will stand it in great stead in the event of any unforeseen events or market downturns.

Real estate portals are choosing to diversify or change their businesses in several ways, and Scout24's is arguably the most successful.

However, the lesson here is perhaps not just that now portals have a model to follow when looking to charge the end user, it's that a big, clunky shop window business can identify how it wants to change and execute it fantastically without breaking the part that made it so successful in the first place.